China is certainly on the nose for investors.

The most common reasons for this revolves around China’s position on Russia, Taiwan and the government changing rules under the ‘common prosperity’ program.

Cameron Robertson who is the co-portfolio manager for Platinum Asia ex-Japan strategy says that people overplay China’s relationship with Russia with respect to the war. He acknowledges that they did not vote in support of the UN resolution condemning the invasion, but they were one of 35 countries that abstained. It should be noted that there were 5 countries that voted in support of Russia, China was not among these.

Alasdair McHugh a director at Baillie Gifford adds that China has distanced itself from Russia since the Ukraine invasion. The foreign minister of China has officially referred to the Russian invasion as a ‘war’, having not done so previously. McHugh believes that the idea that China is ‘all in’ with Russia is wrong as the threat of secondary sanctions if China continues to do business with Russia is a much higher stakes game than what we’ve seen with Russian sanctions. Baillie Gifford’s base case is that China is likely to tread carefully, not least because exports to the US and EU are in excess of US $1trn versus just US $68bn to Russia. McHugh does not think that Beijing will risk losing access to markets in the developed world.

Robertson says that Russia’s invasion seems to have worried people about parallels with China-Taiwan, but thinks people under-estimate how different these two scenarios are. China is a country with huge foreign trade relationships with the West, and trillions of dollars of USD assets, so even just the threat of sanctions are a much bigger stick. Meanwhile Russia’s own attempts have really shown the risks of pursuing such a path as there is no one saying “that looks like a success for Russia, we want to follow that path”. Taiwan has one major political party that is somewhat sympathetic to China, so there is still the glimmer of hope of a peaceful accommodation in China’s eyes – whereas attacking would surely harden resolve against any (even nominal) reunification efforts.

McHugh claims that the current focus on ‘common prosperity’ in much of the Western media portrays this as some sort of attack on capitalism. Helped by the insights we’re gathering from Baillie Gifford’s Shanghai office, he understands common prosperity to instead be about sustainable and inclusive growth. Many companies are well-aligned to such policy directions and he therefore continues to see exciting opportunities ahead.

McHugh believes that China remains a great opportunity for long term growth, and to provide an idea of the scale he says that China has 160 cities with more than 1 million inhabitants versus only 10 in the US. That is a lot of potential consumers.

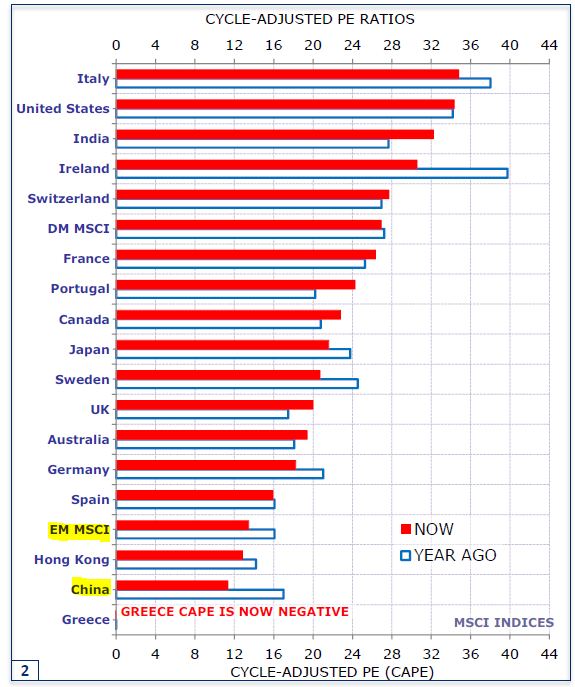

Robertson asserts that China is out of favour and cheap, which is commonly a buy indicator. The discount of the Chinese market can be seen from the chart below which compares the price to earnings (PE) ratios of several countries share markets.

Source: Minack Advisers

Exposure to China has a role to play in investor’s portfolios, tapping into the dynamism of this country and riding the wave of technological innovation that is taking place as new industries develop there.

Robertson highlights AK Medical is a leading provider of hip and knee orthopaedic replacement joints in China accounting for roughly one fifth of the domestic market, providing high-quality cost effective solutions. Their products are internationally competitive, seeing acceptance even in developed markets like the UK. The business expects they will sell around 180 million hip and knee implants this year, up from around 80 million just five years ago. Currently only one out of every 2,000 people in China has a joint replacement each year, this compares to wealthier countries where we typically see rates of one in every 200-300 people having joint replacement surgery each year.

McHugh showcases NIO (electric vehicle maker). NIO’s Chinese name literally means ‘blue sky coming’. It is rapidly scaling production of EVs and thereby supporting China’s climate ambitions. Its trailblazing battery swapping model is inherently more conducive to battery recycling, thereby reducing waste – and it protects the car’s resale value as battery degradation isn’t a factor.

Investing in out of favour sectors is hard, but to ignore one of the world’s largest markets could be a big mistake.

This article was published in the Australian Financial Review during May 2022.