Key points

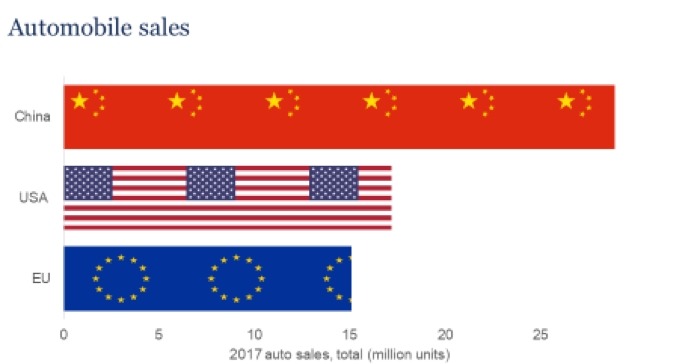

- President Trump’s trade war poses a threat to Australian economic growth particularly via the indirect impact of weaker global activity driving less demand for our exports and lower commodity prices.

- Australia is likely to avoid a recession though reflecting the shock absorber of a lower $A, plenty of scope to cut interest rates and election promises pointing to handouts ahead.

- The trade war has a way to go yet but at least Trump is starting to blink.

Introduction

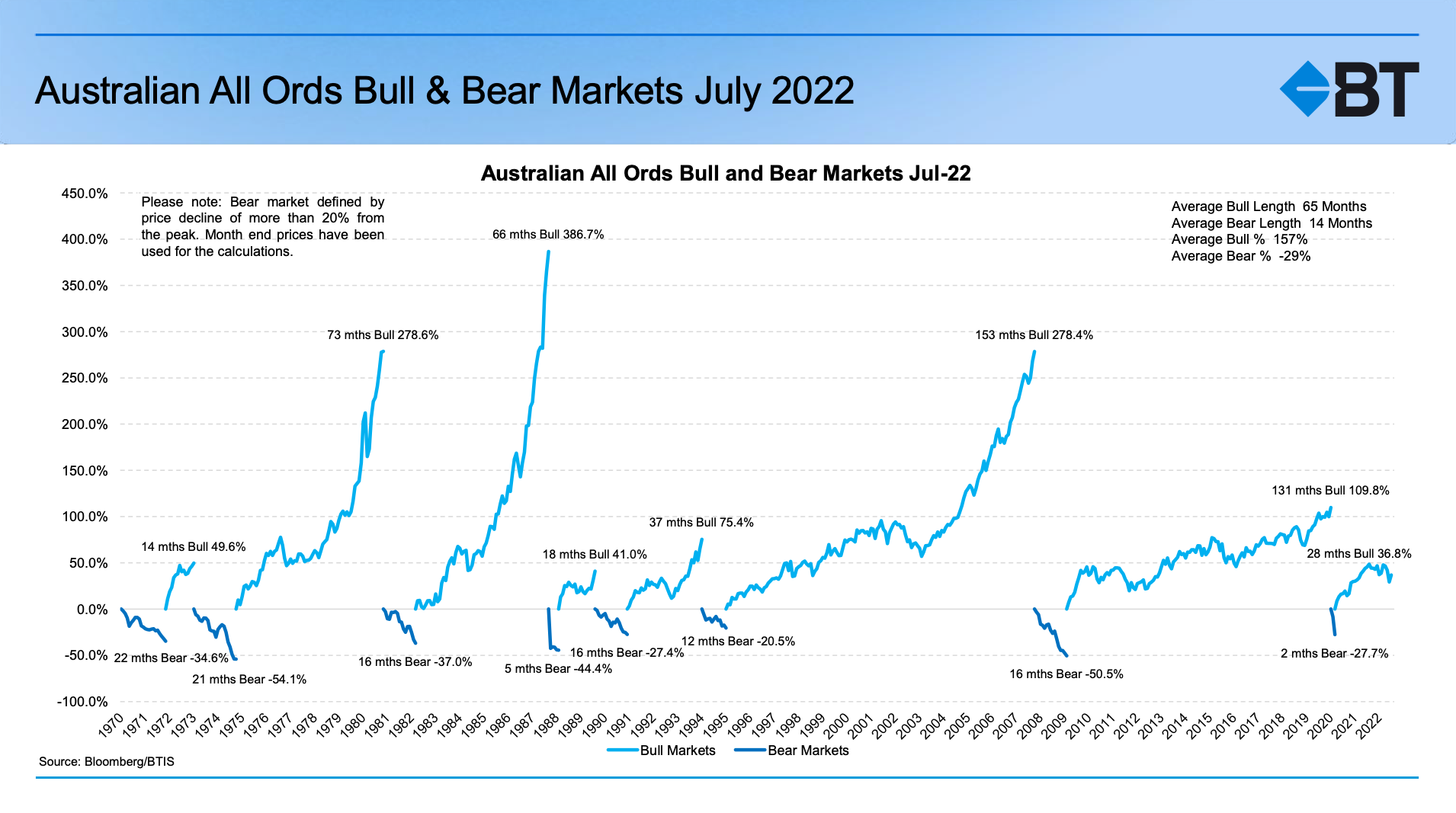

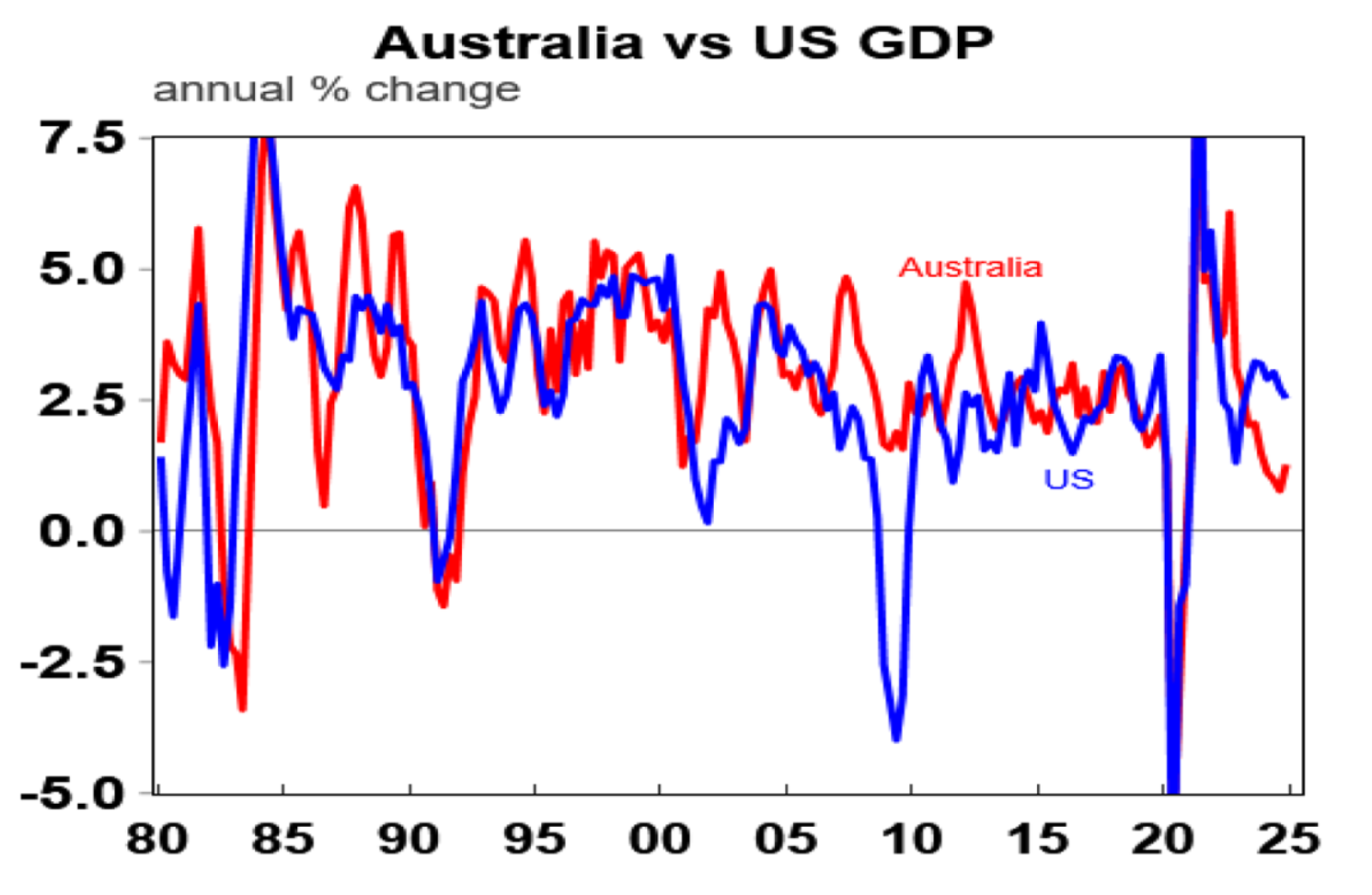

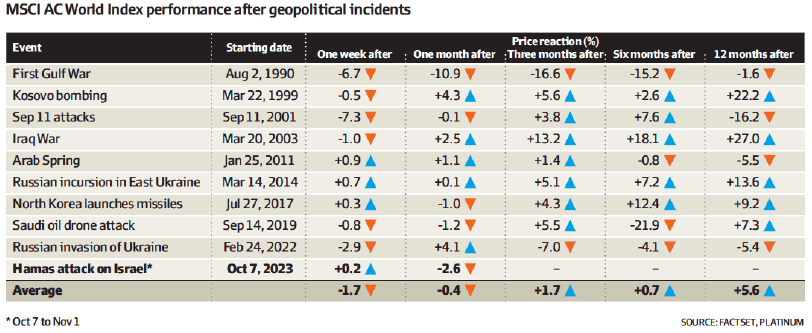

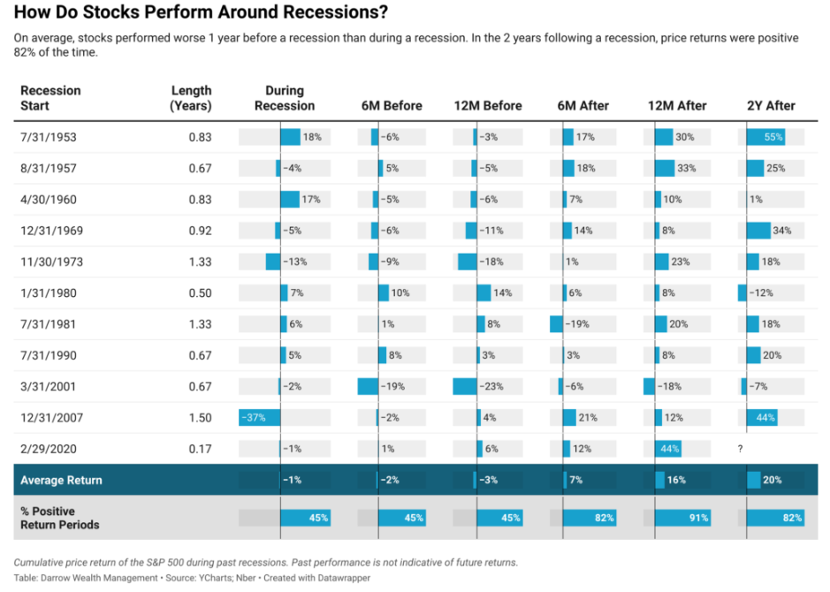

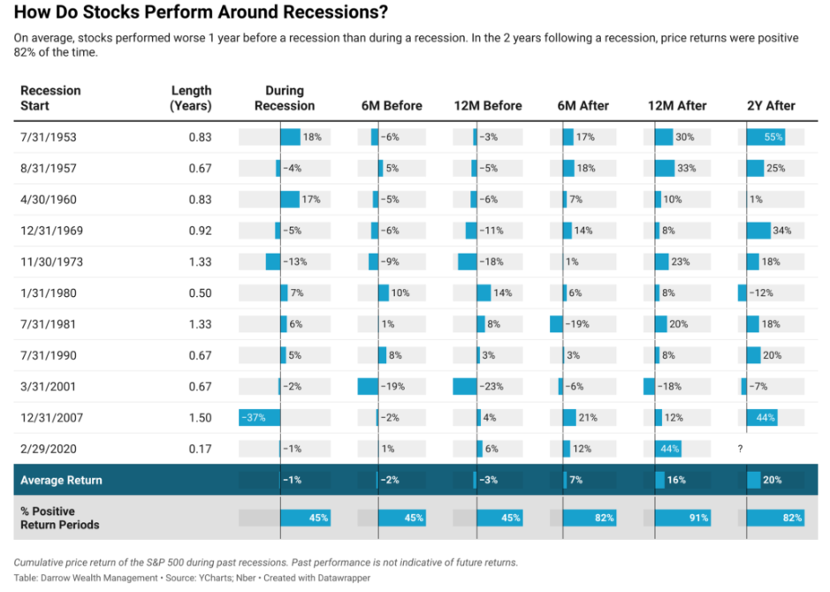

The old saying used to be that “when the US catches a cold Australia catches the flu”. In other words, US economic downturns lead to even bigger downturns in Australia. Fear of downturn or even recession here has risen on the back of President Trump’s or trade war with the rest of the world including ourselves. This has been accentuated by the plunge in share markets, although they have yet to see closing peak to trough falls of 20% or more signalling a bear market which often can be associated with recessions. Several forecasters are already forecasting a US recession, and some are warning of a global recession. To be sure Australian growth is at risk as US and global economic activity deteriorates leading to less demand for our exports, lower commodity prices and a negative impact on confidence. The latter is already evident in a sharp fall in consumer confidence and anecdotal evidence points to weaker home buyer enquiries in the last few weeks. However, there are several reasons why Australia should be able to avoid a recession.

First, Australia has been resilient in recent decades

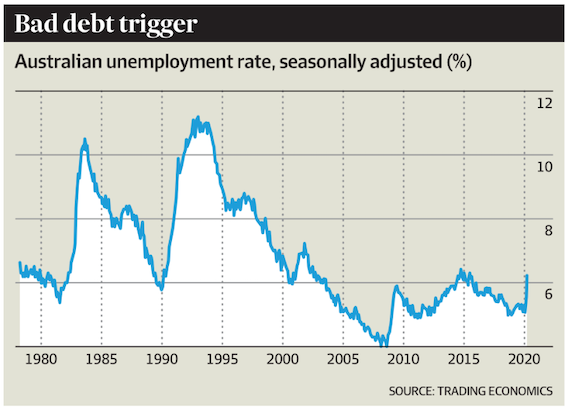

While Australia certainly experienced deep recessions in concert with the US in the early 1980s and 1990s, apart from the pandemic – which does not really count as it was due to health orders to stay at home – this has not been the case in recent decades. Australia avoided recession in the both the tech wreck and Global Financial Crisis.

Second, the global economy should avoid recession

The US is most at risk because it has threatened virtually all of its trade whereas other countries are only seeing their trade with the US impacted. Given Trump’s ongoing policy chaos and the associated uncertainty which is hitting US confidence and decisions to spend and invest along with supply chain disruptions, the risk of a US recession is high at around 45% with 1% to 1.5% likely to be knocked of US growth. But because the tariffs will also add 1% or so to US inflation and the Fed will be worried initially about higher longer term inflation expectations (which have already spiked to levels not see for more than 30 years in the University of Michigan consumer survey) it might initially be slow to respond with lower interest rates (although we do expect Fed cuts from mid-year). The rise in US bond yields despite the threat to growth as foreigners loseconfidence in the US poses an additional risk to the US outlook.

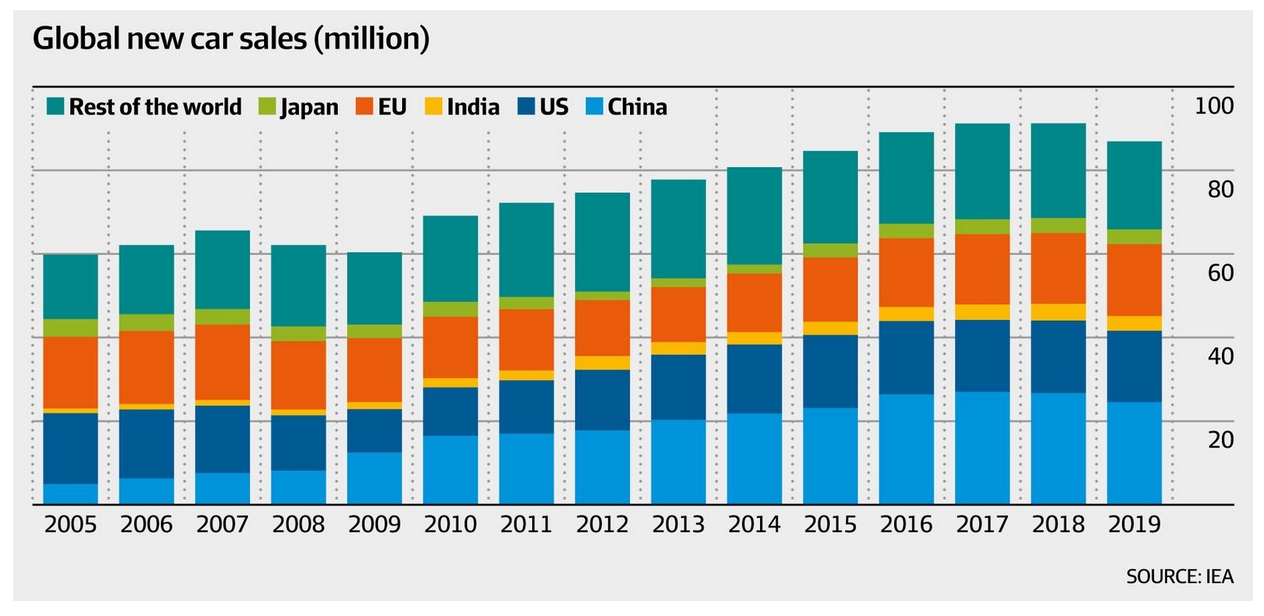

By contrast other countries may see less than 1% knocked of their growth. Chinese growth may come in closer to 4% than previous forecasts for growth around 5% helped by extra policy stimulus offsetting the blow from the tariffs and global growth may be nearer 2% rather than the 3% we had been assuming but the greater scope for rate cuts outside the US may soften this. In other words, the US is at high risk of recession, but global growth is more likely to slow than go into recession. This means the second-round effect of weaker global growth on our exports, while significant at maybe 0.5% of GDP over a year, is unlikely to be devastating.

Third, only 5% of our exports go to the US

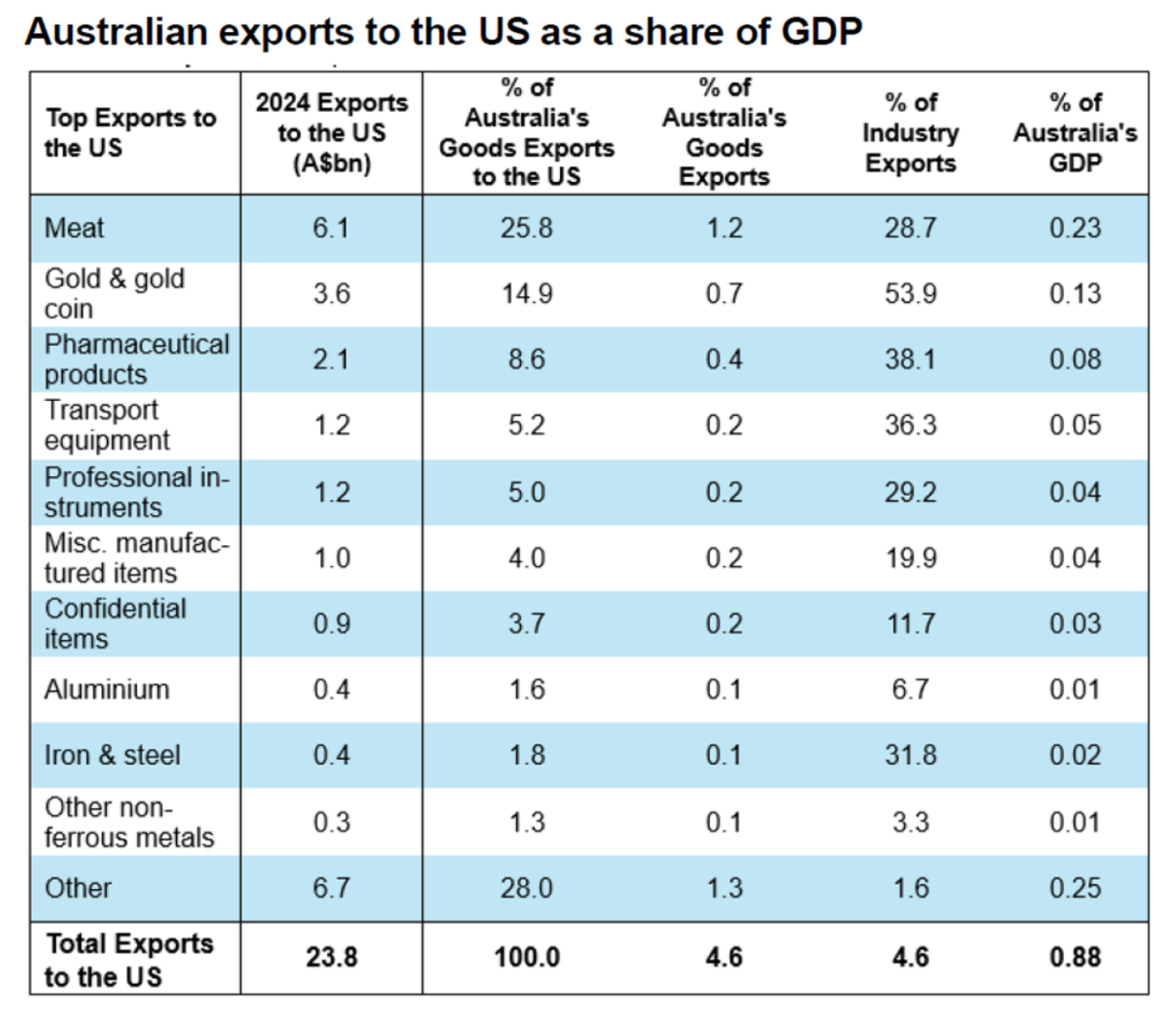

The 10% US tariff on our exports is bad news for industries affected and there is likely more to come for pharmaceuticals (worth $2bn a year). However, only 5% of Australian exports go to the US.

This is worth less than 0.9% of our GDP and much of this will still continue, albeit the tariffed goods will now more expensive in the US. What’s more much of it is fungible such as the $3.6bn in gold exports and $6.1bn in beef and should be able to find other markets. So, all up the direct hit to GDP growth is probably only 0.1% at most.

Fourth, a lower $A will provide a shock absorber

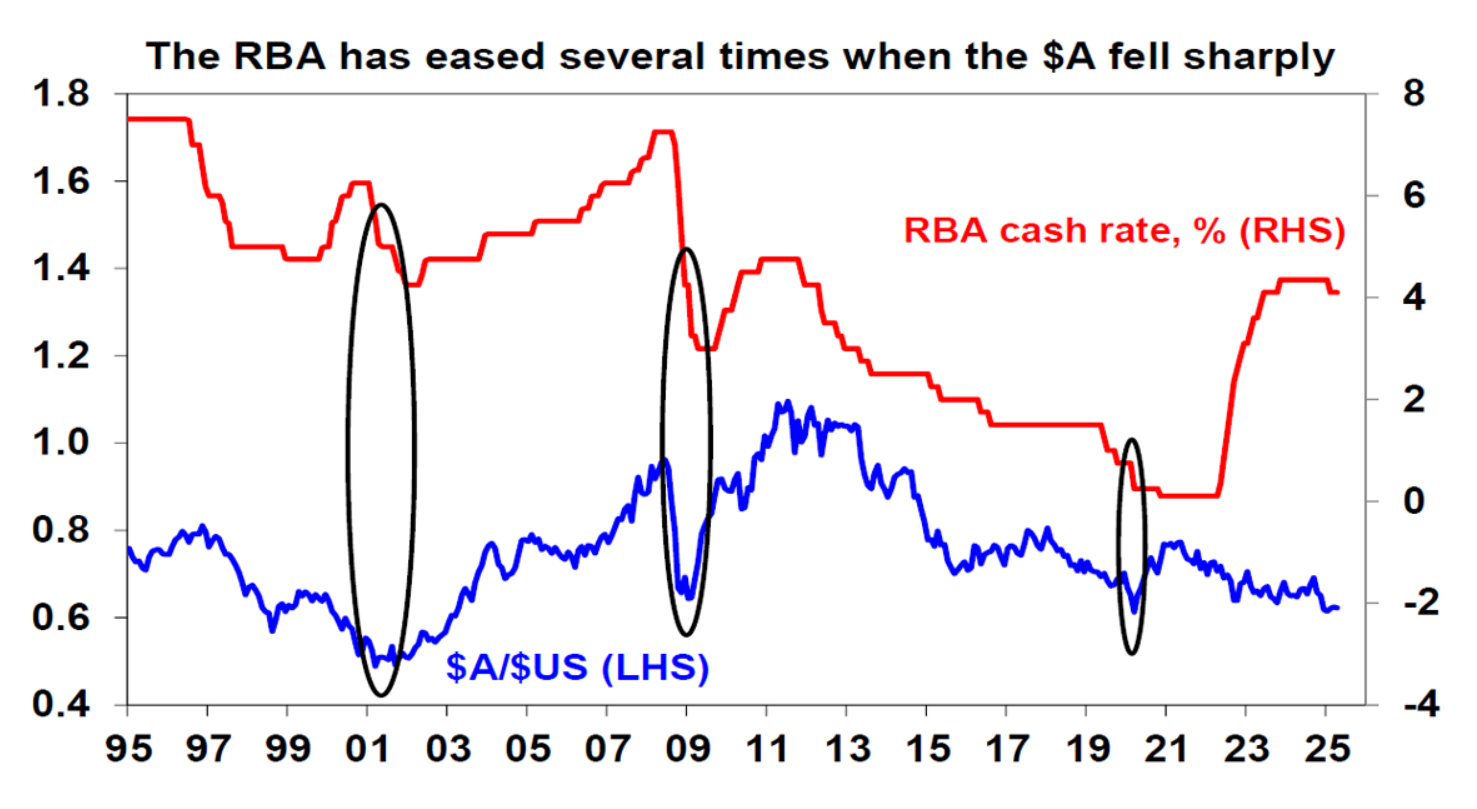

A plunge in the value of the Australian dollar partly explains why Australia was protected from the tech wreck, the GFC (the $A fell 39% at the time) and the pandemic (when it fell 19%) and the same is likely to apply this time. Since its high last September to its recent low as share markets plunged, the $A has fallen about 14% against the $US, reflecting fears about the outlook for global growth and commodity demand. This helps support the Australian economy by making Australian exports relatively cheaper (offsetting the impact of the tariffs) and boosting the Australian dollar value of commodities when their US dollar value is falling. Since the panic lows in shares a week ago the $A has bounced back to around $US0.63 but it’s likely to fall again if the growth outlook deteriorates anew and sharemarkets have another leg down.

Out of interest a fall in the $A by boosting the value of foreign assets also reduces the losses on international shares for investors, including those in super funds, providing those investments were unhedged.

Fifth, the RBA has plenty of scope to cut rates

We continue to see the tariff shock as likely adding to RBA rate cuts this year. And unlike going into the pandemic when the cash rate was just 0.75% the RBA has plenty of scope to cut this time around as the cash rate is at 4.1%. Things have not become bad enough to justify an emergency RBA meeting as some have been calling for or make a 0.5% cut in May a base case. The local financial markets are functioning well, and the banking system is well capitalised with no signs of unusual stress (unlike the situation in late 2008 in the GFC or even in the early stages of the pandemic). In fact, an emergency RBA meeting may just create asense of panic.

But we are of the view that the RBA will cut in May by 0.25% with maybe a 35% chance that it’s a 0.5% cut with several more rate cuts into early next year. While the $A recently fell to a five-year low, posing some upside risks to inflation this is likely to be minor in the face of the potential shock to growth and the diversion of some other countries exports from the US to Australia. The $A fell 39% in the GFC and 19% in the pandemic and yet the RBA still cut rates then – see the next chart - because the threat to growth swamped any threat of higher inflation and the same will likely apply now.

Sixth, election promises point to easing fiscal policy

With the Federal election now less than three weeks away Australians are being bombarded with spending and tax break commitments from both sides of politics. Notably the Budget included a small tax cut, and Labor is promising a standard $1000 tax deduction with both starting next financial year and the Coalition is promising a return of the low and middle income tax offset resulting in a one-off tax rebate of $1200 for middle income earners also for the next financial year, which risks dragging on into future years. There are lots of other goodies on top of this. The spendathon is bad economics, but points to a further easing infiscal policy imparting a modest stimulus for the economy.

Finally, Trump may be getting a bit “yippy”

The past week has seen Trump blink in the face of the market mayhem he was causing and the backlash from American consumers and businesses. The justification for the tariffs was always hard to pin down precisely with talk of: “escalating to de-escalate” as part of a negotiation to get better trade deals; retaliation for foes and allies “ripping us off”; border control and drugs; annoyance at other countries various regulations and value added taxes; to raise revenue with an “External Revenue Service” to pay for income tax cuts; to bring production back to the US to usher in a new golden age; as part of a “detox” for the economy; and with some concluding it’s all part of a strategy to cause a recession and lower interest rates so US debt could be refinanced at lower rates. And the formula used to drive the reciprocal tariffs (trade deficit with country divided by imports from that country) made no economic sense. Such an array of justifications arguably provides Trump with the flexibility to back down somewhat and ultimately declare victory. This may now be getting underway with Trump first dropping all the reciprocal tariffs to 10% and then announcing a temporary exclusion for smart phones and computer equipment – although they look like they will get their own separate tariff. Leaving the 145% tariff on Apple iPhone 16 Pro imports from China would have seen their retail price surge from around $US1100 to $US1800 if Apple maintained its margins which clearly it couldn’t – so bad news for both Apple and US consumers.

It's clear that the Administration is getting nervous in the face of the backlash from US businesses and consumers and importantly the worrying rise in bond yields in the US suggesting that the US is suffering from capital outflow and may be losing its safe haven status. The latter is a big concern for the Trump

Administration as it needs lower not higher bond yields to finance its $US2trillion deficit and $US36trillion in debt.

So, Trump looks to be getting a bit “yippy, afraid” (his words) and is maybe slowly pivoting towards negotiation. The trouble is that China is showing no signs of being the first to seek a start to negotiations and sensing signs of weakness other countries may not give away as much in any negotiations. In fact, it may make more sense for many countries annoyed at Trump’s approach to sit it out.

The bottom line is that Trump may be starting to back away a bit. There’s a long way go though, and shares remain at high risk of further lows after their current bounce as tariff uncertainty continues. But at least Trump is starting to blink, suggesting worst case scenarios for global growth and hence a flow on to Australia may be receding in probability.

Concluding comment

The risk is high, and Australia may not see the pickup in growth to around 2-2.5% or so this year that many including ourselves had been forecasting. But Australia should be able to avoid a recession in the face of Trump’s trade shock.

This article written by Shane Oliver

Chief Economist AMP

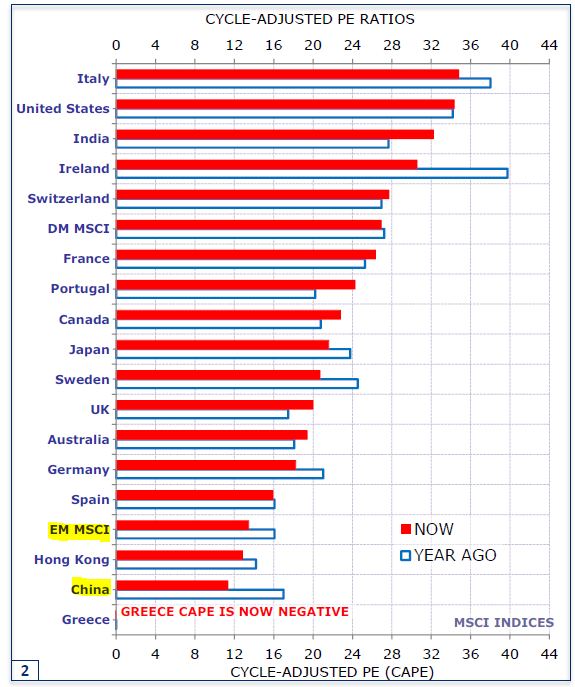

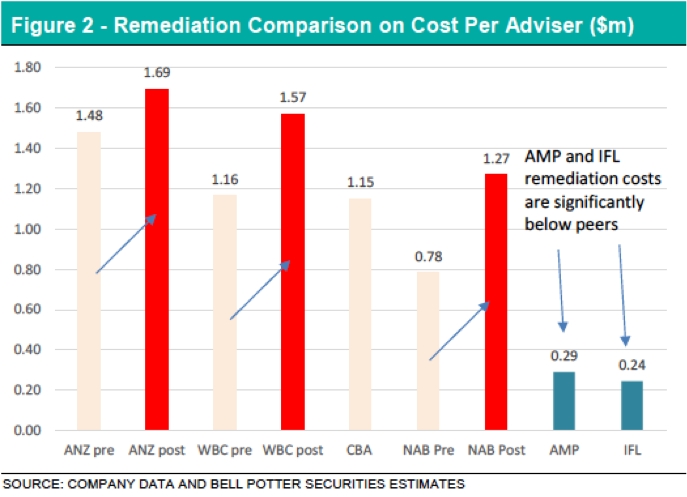

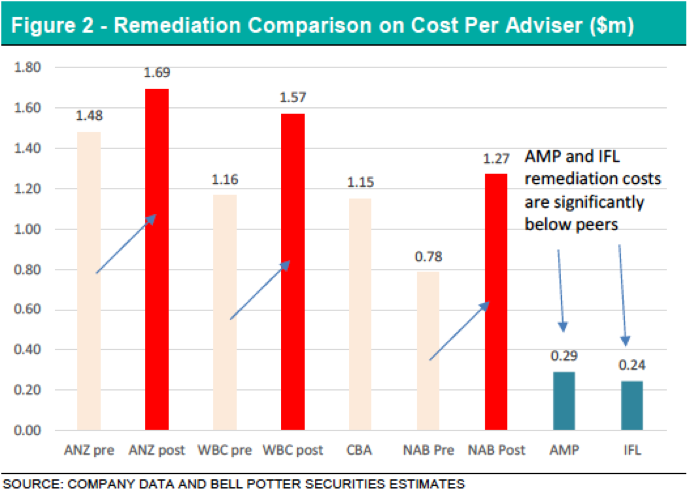

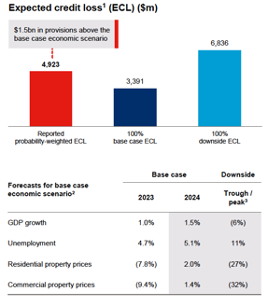

Westpac, NAB and ANZ have reported their annual results for the year ending 30th September 2024 and they all show that profit margins are under pressure and, despite nominal bad debts, profit growth remains elusive. How then to explain the record valuations of this group, not to mention CBA which is the most expensive bank in the world.

Westpac, NAB and ANZ have reported their annual results for the year ending 30th September 2024 and they all show that profit margins are under pressure and, despite nominal bad debts, profit growth remains elusive. How then to explain the record valuations of this group, not to mention CBA which is the most expensive bank in the world.

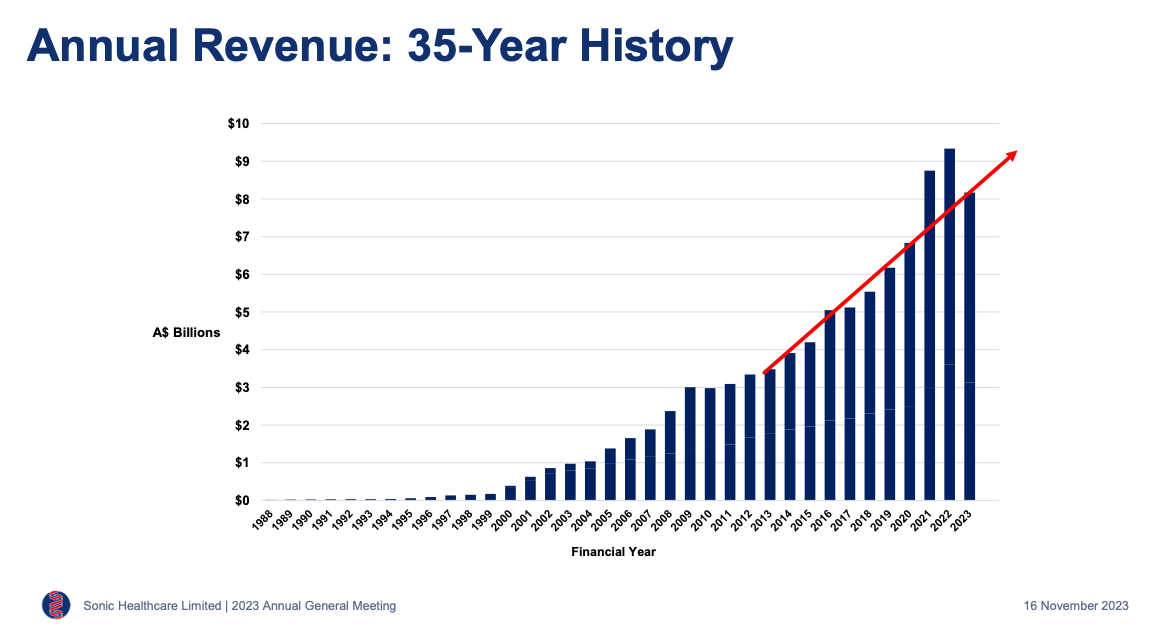

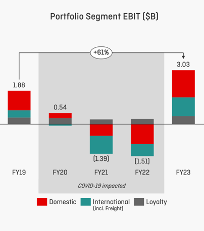

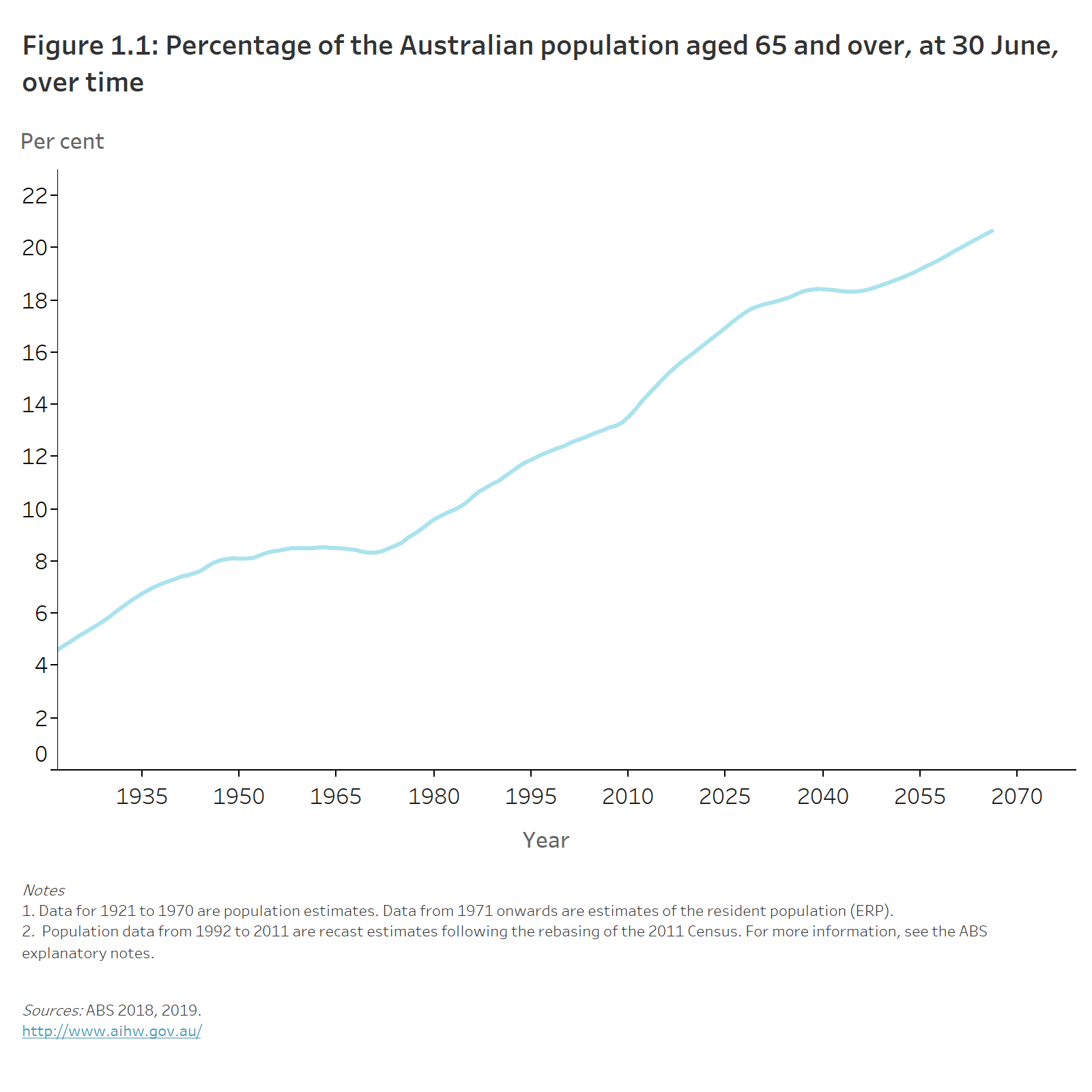

The current share prices of all 3 Australian listed pathology companies are below pre-COVID levels. In Sonic’s case, this is despite earnings per share in financial year 2023 being 19% higher than that in the 2019 financial year. Investors should ask themselves whether this represents a buying opportunity.

The current share prices of all 3 Australian listed pathology companies are below pre-COVID levels. In Sonic’s case, this is despite earnings per share in financial year 2023 being 19% higher than that in the 2019 financial year. Investors should ask themselves whether this represents a buying opportunity.

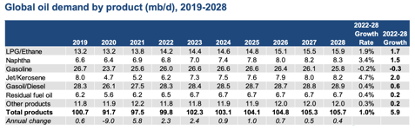

Artificial Intelligence, known as AI has been a hot sector so far in 2023. Computer chip designer Nvidia Corp, the current poster child of AI, has seen its share price rise around 200% this calendar year, while Microsoft is up around 50% so far this year.

Artificial Intelligence, known as AI has been a hot sector so far in 2023. Computer chip designer Nvidia Corp, the current poster child of AI, has seen its share price rise around 200% this calendar year, while Microsoft is up around 50% so far this year.

Warren Buffett’s two golden rules for investing are, 1. Don’t lose money 2. Never forget rule one.

Warren Buffett’s two golden rules for investing are, 1. Don’t lose money 2. Never forget rule one.