With the constant symphony of politicians from all parties clamouring over each other to bash up the banks and accuse the Australian banking industry of profiteering from mortgage holders since the GFC, we examine the truth behind why the interest rates on home loans have risen more than the official Reserve Bank cash rate.

First some revision, where do banks source money to enable them to lend out to homeowners? Banks can either attract deposits by offering term deposits and cash accounts or they can "buy" money from the wholesale market, largely from overseas.

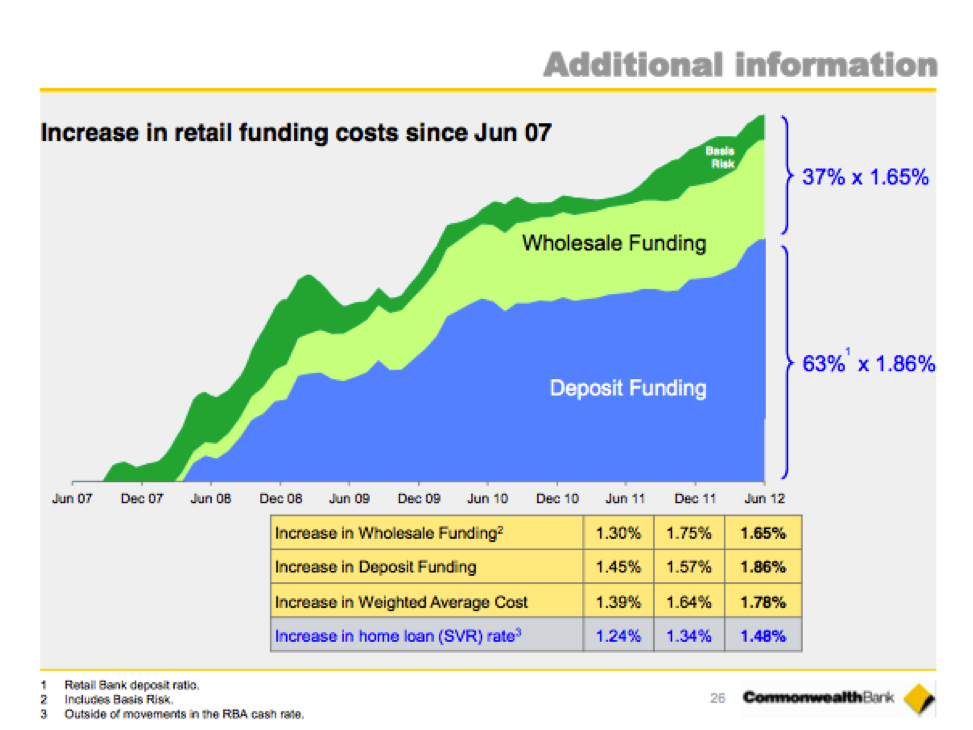

The graph below shows the increase in the cost to acquire these sources of funding since the start of the GFC, courtesy of Commonwealth Bank's analyst pack at their recent results presentation.

The chart highlights that Australian banks have paid an additional 1.65% to obtain funds from the wholesale market and have had to pay cash account and term deposit holders 1.86% over what they were paying before 2007 to attract funds. Those who watch term deposit rates would know this as term deposits are currently more than the RBA official cash rate of 3.5%, whereas prior to GFC banks paid around 1.5% below the cash rate for deposits (source RBA Bulletin March 2010)

Despite having to pay on average 1.78% more to acquire funds to lend out, CBA's increase to the standard variable home loan rate has been less than 1.5% which means that the bank has absorbed some of the pain of the increase cost of funding.

The bank bashers will not accept this and point to their record profits. The banks higher profitability has come through acquiring several of the second tier lenders such as BankWest (CBA) and St George & RAMS (Westpac) so one would hope their profits are higher as their businesses are now much larger.

We readily accept that the cost to build a house has increased due to the increased cost of raw materials such as steel and timber, and yet when the cost of "raw materials" for banks increase we accuse them of gouging.

Australia should be proud of our healthy banking system and pay no attention to the ill informed politicians who are bank bashing to distract voters from their own inadequacies.