We recently met with Geoff Wilson, CEO Wilson Asset Management to discuss his view of the ALP proposal to scrap imputation credit refunds.

Geoff believes that this is policy on the run, which has not been thought through and disadvantages self funded retirees in 'the middle' and most certainly doesn't impact the 'big end of town' as Bill Shorten makes out.

Wilson Asset Management have established an online petition that investors can sign voicing their disapproval of this policy position. We would encourage you to sign this petition online. Here is the link to the petition.

Sign the ONLINE PETITION AGAINST SCRAPPING IMPUTATION CREDIT REFUNDS

Below is the podcast we created with Geoff, complete with a transcript for those who would rather read than listen.

Speakers: Mark Draper (GEM Capital) and Geoff Wilson (CEO Wilson Asset Management)

Mark: Here with Geoff Wilson from Wilson Asset Management. Geoff, thanks for joining us.

Geoff: Hi, thanks. It’s great to be here in Adelaide. One of my favorite cities.

Mark: We’re meeting, talking about the ALP’s proposal on dividend imputation and particularly what the impact of it is. But let’s start with—

Geoff: And not one of my favorite topics. [Laughs]

Mark: Neither with us, it’s safe to say. Probably the best place to start is just to talk through what the ALP are proposing and before that, just to give a quick bit of background on what actually dividend imputation means and what it is.

Geoff: Yeah. I mean, to me, dividend imputation, it was very intelligent doing that. What it’s trying—well, it what it was brought in for, was to stop the double taxation effect.

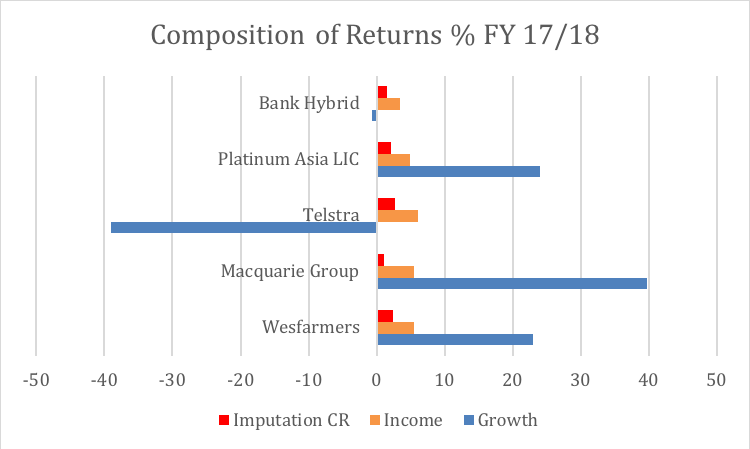

So, if tax was paid by a company, then the individual wouldn’t have to pay tax and it was seen as being unfair. Effectively that would be—historically it’s been double taxation and that’s why imputation came in. And yeah, you end up—if tax has already been paid by the company, say at 30% and you’re only paying 10% tax, then you’ll get that other benefit, the other 20% back from the government.

And effectively what the ALP has said, is that we are not going to let that occur. And to me, it was just a classic—

[Chirping sound.]

Mark: We’re shooting this in an office, by the way.

Geoff: Yeah, that’s right.

Mark: It’s just Geoff’s phone. [Laughs]

Geoff: No, no, there was a frog in the corner. [Laughs]

[Laughter]

I mean, the ALP, the policy that they came up with just recently is—to me it is just so incredibly unfair.

Mark: Yep, yep. And we’ll talk about who it’s unfair to in a second. Wasn’t it ALP that originally bought in dividend imputation back in…whenever it was?

Geoff: Correct. Yeah, correct, it was. And the incredible thing is, the changes they propose recently, even though the refunds you get, if you’ve paid in theory, you know, there’s been too much tax paid, you know, the Liberal Party bought in, but it was actually the ALP’s plan to bring it in, but Liberals happened to be in office at that time.

Mark: That was in the year 2000.

Geoff: Yeah. Yeah. I mean, to me, it’s a little fascicle that part. You know, they’re trying to blame it on the Liberals. And things have changed significantly since then. To me, it is so unfair and cruel what they’re doing with this policy because this—yeah, I’ll go to superfund, yeah, I’m over the $1.6 million cap. This will affect me, but I’m in pension mode.

Mark: This is you personally?

Geoff: Yeah, personally, yeah. And my advisor says, “Well, Geoff, you just go back to 100% accumulation.” In theory, they talk about getting the big end of town—like hey, I don’t know which end of town I live at—

Mark: Yeah. But they’re not going to impact you with this

Geoff: They’re not going to impact me. And so to me, it’s just—and what makes me so angry, like we’ve got with our listed investment companies, we’ve got 55,000 shareholders. 60% of them are self-managed super investors and that live on what they give back or what they get through their income and this is going to have a significant impact on them.

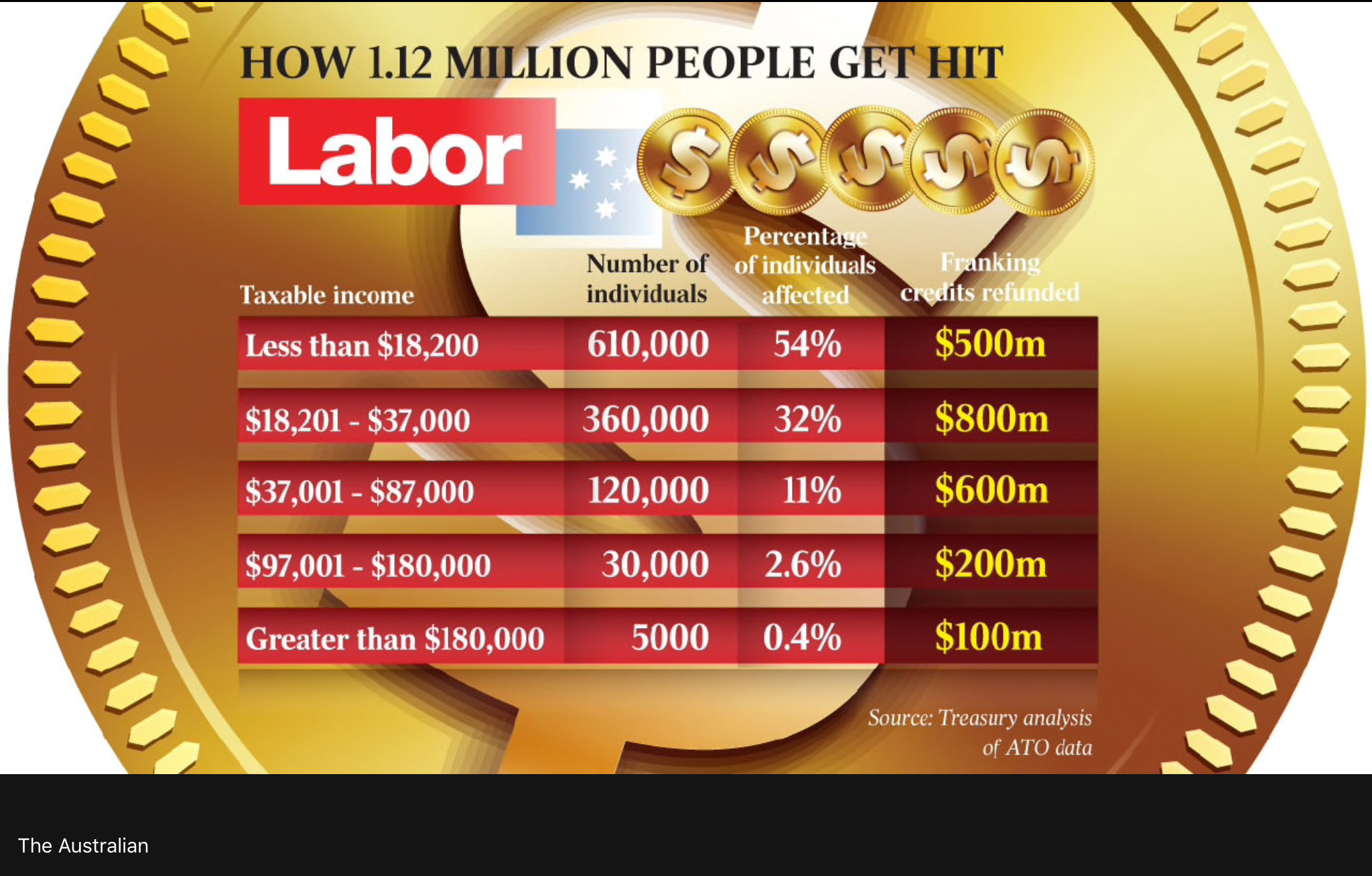

Mark: Let’s look at who does this impact because it doesn’t impact the people who’ve got millions of dollars, which is ironically is the very target that Shorten was allegedly trying to get at with this policy. So who does this negatively impact?

Geoff: Well, in theory, it impacts everyone in the middle. Well, first of all, they came out with a policy and then they realized—to me, it’s policy on the run. They come out with something illogical, they haven’t even thought it through.

Mark: Yep. They didn’t even know who it impacted on day one, did they?

Geoff: No. No. That’s right. And then they had to come out and change it and say, “Look, okay, it won’t impact on people on pensions and part-pensions.” But what about all those other people? So, in theory, he was trying to say, “Oh, it’s the big end of town,” but it’s not impacting on that end of town, the wealthy. It’s actually impacting on the people that are in—have their own self-managed super funds, live on that income or those refunds, and all of a sudden, yeah, their income could be chopped by 15%. I mean, that is appalling.

Mark: Yeah.

Geoff: And particularly after—it’s not as if they haven’t had enough pain. The goalposts keep moving in that area. We had the Liberals bring in their cap, that moved the goalpost 1 degree.

Mark: Yeah, and they had already reduced the asset test level back in 2016, I think as well. I think it’s 2016 or 2017, fairly recently. So, the poor people who’ve had $800,000, who saved all their life and worked really hard to accumulate that level, lost $15,000 worth of age pension and now they stand to lose probably another 10. So, we did the math on it and worked out somebody with $800,000 stands to lose about 40% of their income in the last two years.

Geoff: Gee!

Mark: That’s where the middle ground, is what you were talking about, given that 800 is roughly where the pension cut-out limit is for a married couple and a bit more than 500 for a single person.

Geoff: And you think of that if you’re retired, I mean, that is brutal.

Mark: Yeah, absolutely.

Geoff: That is brutal.

Mark: It’s not hitting the big end of town, clearly. It is hitting the middle. They’re giving exemptions, which are going to be very, very difficult to actually administer. Let’s not even get down that path because the exemption, I think, at the moment, is relating to people who were on a part pension.

Who are the people other than the big end of town with superannuation, self-managed funds, or people with reasonable balances, who else gets out of this? Who else is not impacted by this?

Geoff: Well, I mean, the big industry funds. Which it impacts on the self-managed super, players—

Mark: Yeah, but not for big super funds.

Geoff: Yeah, but not for big industry funds. So, to me, that’s again, an unfair thing. And we talked about the financial impact, but there are other impacts. Which, I mean, we see it with our shareholders. On a six-monthly basis, we present to them and a lot of people—having a self-managed super fund in retirement becomes—investing becomes part of their life. They follow the market very closely, they have good advisors, etc. And to me, what we haven’t measured is if they’re trying to do this to the self-managed super funds, is the actual negative mental health impact that it has. Say I’ve probably got my 800,000, oh, well, I’m not going to have a self-managed super fund anymore. I won’t have the enjoyment of managing my own money or being involved in managing my own money—which Labor is trying to push them to—I’ll just put it in an industry fund and be done with it. And then I go and sit on the beach and twiddle my thumbs.

To me, there are all these unintended consequences and to me, mental health of an aging population is very important. And mental health has got to be one of the biggest problems globally.

Mark: What do you see as some of the other unintended consequences? Because one of the problems of policy on the run, which this clearly is, is that you’re not thinking through about the domino impacts. I mean, I just am reminded of the resources tax when that was brought in on the run and the dominoes were never considered in that. What are some of the other unintended consequences here, Geoff?

Geoff: Well, then as an investor—I mean, you want people investing in companies. You want actually to invest in small or medium-size growing companies and they are the life blood—

Mark: Life blood of the economy.

Geoff: Of the economy. So you want people investing in sort of productive assets. You don’t want them investing in unproductive assets. And sort of what this does do, is drive money away from those productive assets. Am I better off investing in property or in a property trust where there’s—

Mark: There’s no franking.

Geoff: No franking. And so money is going into other areas. Am I better off investing it overseas?

Mark: So, it’s really removed.

Geoff: The tax rate in the U.S., you know, Trump’s dropped it to 21%. Am I better off investing in a company where it only pays 21% tax rather than one where it pays 30% tax?

Mark: Yeah.

Geoff: To me, it’s all these unintended consequences.

Mark: Yeah. No, that’s a good point and it’s really removing some of the oxygen from the economy. It’s got potential to remove oxygen from the economy, essentially.

Geoff: Yeah. And move money where it shouldn’t be moved to in theory. [Laughs]

Mark: Yeah, yeah.

Geoff: Now, does anyone—I know properties find it a little bit tough at the moment, but do you want—we all have to live in a home. We want to buy property as cheaply as we can. Do you want anything pushing it up? No. [Laughs]

Mark: Yeah. Well, that’s quite comical that on one hand, Bill Shorten is saying, “Oh, we’re here for housing affordability,” and then on the other hand, he’s saying, “I don’t mind people pouring more money into property,” which can push the price up. It’s totally illogical.

Geoff: Yeah, yeah.

Mark: So, Geoff, just to finish up on, what would be your advice to investors at the moment? You deal with the whole swag of retiree investors, which is pretty much the audience we’re talking to here today. What would your advice be today on how people should frame this and how they should think about it and what they should do right now.

Geoff: Yeah. Well, I mean, to me, you—well, first of all, we’ve seen that Labor, with policies on the run, they have flexibility to change.

Mark: Yep.

Geoff: I mean, the better scenario is we don’t have to worry about this, so in the next election, next year sometime, the Liberals get in, but who knows.

Mark: Yep.

Geoff: But definitely put as much pressure as you can on any local member, any Labor member. Write to them just how appalled you are at what they’re doing. To me, it’s just the—like how many retirees do we have in Australia or, to me, there’s got to be a big group of people that are putting—that are making Labor realize that if they do this, there are significant consequences.

Mark: That’s very interesting you say that. We agree. In terms of adjusting investments right now, is that something you do or would you leave that for now, given that A) They’re not in yet; and secondly, this is only policy proposal with nothing supporting it. What would you do on that?’

Geoff: I definitely wouldn’t. I would definitely stay close to it. I would get as much advice as you can.

Mark: And write to your—or go and see—your Labor local MP.

Geoff: Yeah.

Mark: But not adjust your investments at the moment?

Geoff: I wouldn’t. I wouldn’t. Because, I mean, you’d hate to change your portfolio or change your investments and it doesn’t happen and then you really got to work out how you’re going to deal with it. Assuming it is going to happen, and then how you’ll deal with it. And to me, you have the plan and if Labor get in, yeah then you have to—

Mark: Then you execute it at that point.

Geoff: Yeah.

Mark: Geoff, thanks very much for your time. Very interesting issue. We’re both on the same page with it, so appreciate your input.

Geoff: Thanks for that. Thanks, Mark. Thanks.

[End of Audio]