Superannuation measures

Accumulation phase and Contribution Measures

Concessional contributions cap will be reduced

The annual cap on concessional superannuation contributions will be reduced to $25,000 from 1 July 2017. There will be one cap for all taxpayers irrespective of their age.

The cap is currently dependent on the age of the taxpayer as on 30 June of the previous financial year:

- under age 49 - $30,000

- aged 49 and over - $35,000

GEM Capital Comment

The reduced concessional contributions cap of $25,000 does not apply until 2017-2018. Clients should consider taking advantage of the current higher concessional cap of $30,000 (under age 50) and $35,000 (age 50 and over) in the 2015-2016 and 2016-2017 financial years.

Catch-up concessional superannuation contributions will be allowed

From 1 July 2017, individuals will be allowed to make additional concessional contributions where they have not reached their concessional contributions cap in previous years.

Access to the unused cap amounts will be limited to individuals with a superannuation balance less than $500,000.

Amounts are carried forward on a rolling basis for a period of five consecutive years. Only unused amounts accrued from 1 July 2017 can be carried forward.

The Government has recognised that annual concessional caps can limit the ability of people with interrupted work patterns to accumulate superannuation balances commensurate with those who do not take breaks from the workforce. Such individuals would include stay at home parents and/or carers. Allowing them to carry forward their unused concessional cap provides them with the opportunity to ‘catch up’ if they have the capacity to do so, and choose to do so.

The measure will also apply to members of defined benefit schemes. The Government will undertake consultation in this regard.

GEM Capital Comment

The ability to carry forward unused concessional cap amounts appears to apply to everyone who has contributed less than the concessional cap, not just those who take breaks from the workforce such as home parents and carers.

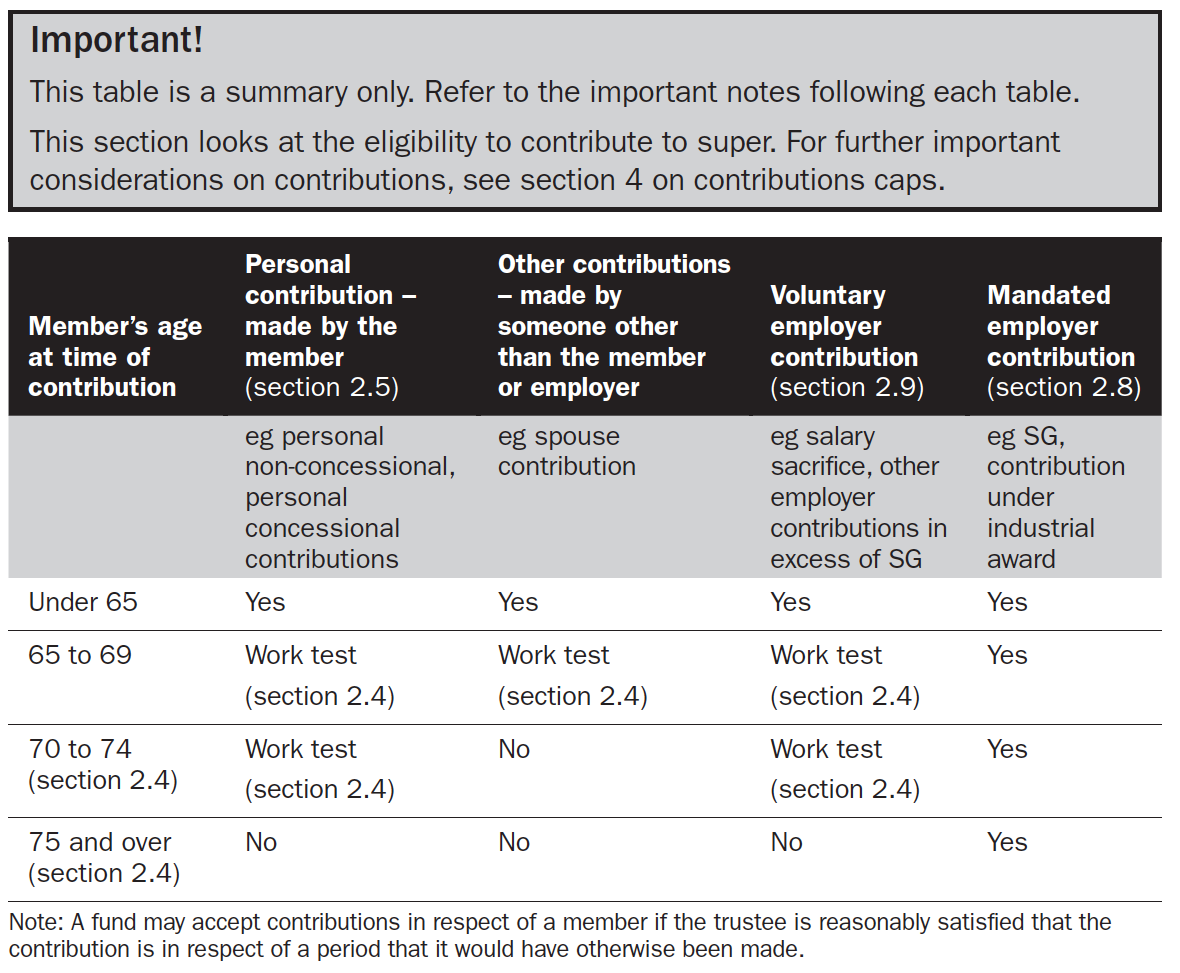

Harmonising contribution rules for those aged 65 to 74

From 1 July 2017, the Government will remove the existing restrictions on people aged 65 to 74 from making superannuation contributions for their retirement.

People under the age of 75 will no longer have to satisfy a work test and will be able to receive spouse contributions.

This measure is intended to simplify the superannuation system for older Australians and allow them to increase their retirement savings, especially from sources that may not have been available to them before retirement, including from downsizing their home.

Currently, the work test applies which requires individuals aged 65 or over to be in gainful employment for at least 40 hours within 30 consecutive days in a financial year before their super fund can accept any contributions for them.

Introduction of this measure will effectively make the work test irrelevant past 1 July 2017.

GEM Capital Comment

Clients are currently required to work 40 hours within 30 consecutive days in the financial year they make a contribution over the age of 65. This proposal will remove this requirement and make it easier for older clients to contribute to super.

When combined with the life-time non-concessional cap this proposal could allow non-working clients aged 65-74 who were previoulsy not eligible to contribute to make non-concessional contributions of up to $500,000 after 1st July 2017. It also would appear to open the door to tax deductible super contributions for those 65 - 74 who receive other taxable income such as a Government Superannuation Pension.

Personal superannuation contributions will be tax deductible

From 1 July 2017, all individuals up to age 75 will be able to claim an income tax deduction for personal superannuation contributions. This effectively allows all individuals, regardless of their employment circumstances, to make concessional superannuation contributions up to the concessional cap.

Beneficiaries of this change include:

- individuals who are partially self-employed and partially wage and salary earners; and

- individuals whose employers do not offer salary sacrifice arrangements will benefit from these changed arrangements

Currently, there is ‘a maximum earnings as an employee’ condition which needs to be satisfied in order to claim a deduction for personal superannuation contributions. Broadly, less than 10% of the total of taxpayer’s assessable income, reportable fringe benefits and reportable superannuation contributions may be in relation to an eligible employment activity. This essentially means that many self-employed professionals who work independently but are deemed employees under the superannuation guarantee law cannot make further voluntary deductible contributions to super.

GEM Capital Comment

This announcement will dramatically simplify the eligibility requirements for a member to qualify to claim a deduction for a personal super contribution. The requirement to not be an employee during the financial year or to satisfy the 10% test will be replaced with a single requirement to be under age 75.

The announcement also gives employees more flexibility and allows them to make personal deductible contributions in addition to super guarantee and salary sacrifice contributions, to use up any unused concessional cap at the end of the year.

A new lifetime cap for non-concessional superannuation contributions

The Government will introduce a $500,000 lifetime non-concessional contributions cap. This lifetime cap will be available to all Australians up to and including the age of 74.

For taxpayers aged 75 and more existing rules will remain – only mandated contributions can be accepted by their superannuation fund.

The cap will take into account all non-concessional contributions made on or after 1 July 2007. This is the time from which the ATO has reliable contributions records.

The measure will commence at 7.30pm (AEST) on 3 May 2016.

Contributions made before commencement cannot result in an excess. However, excess contributions made after commencement will need to be removed, otherwise penalty tax will apply.

The cap will be indexed to average weekly ordinary time earnings.

The cap will replace the existing annual non-concessional contributions caps of $180,000pa (or $540,000 every 3 years for individuals aged under 65).

This measure is intended to improve the sustainability of the superannuation system. According to the Government, the change will continue to provide support for the majority of Australians who make non-concessional contributions well below $500,000. Further, there will be more flexibility around when people choose to contribute to their superannuation.

Existing arrangements in respect of CGT cap (set at $1.415 million for 2016-17 financial year) will be retained. Effectively this means that small business taxpayers eligible for CGT concessions can place proceeds from realising their business into the superannuation system.

GEM Capital Comment

To determine how much of the lifetime non-concessional cap has been utilised with prior non-concessional contributions, clients will need to add their non-concessional contributions since 1 July 2007 from all funds to determine how much counts towards their lifetime non-concessional cap.

While the Government states the ATO has reliable contribution records since 1 July 2007, it is not clear whether clients will be able to access this information. Clients may need to contact the relevant super funds for confirmation.

Clients who have previoulsy utilised the bring-forward provisions will need to carefully review their situation to determine whether they have exhausted their lifetime cap.

Prior to recommending a non-concessinal contribution, advisers should ascertain the amount of lifetime non-concessional contribution cap that the client has available.

The introduction of the lifetime non-concessional cap may limit the ability to implement a recontribution strategy. Strategies such as spouse contributions which count against the spouse's lifetime non-concessional cap may assist.

Advisers may wish to refrain from providing advice to make non-concessional contributions until the amount of a clients non-concessional contributions made since 1 July 2007 can be verified.

Improving superannuation balances of low income spouses

From 1 July 2017, the Government will increase access to the low income spouse superannuation tax offset by raising the income threshold for the low income spouse from $10,800 to $37,000.

A new Low Income Superannuation Tax Offset (LISTO)

The Government will introduce a Low Income Superannuation Tax Offset (LISTO) to reduce tax on super contributions for low income earners, from 1 July 2017.

The LISTO is a non-refundable tax offset for superannuation funds, based on the tax paid on concessional contributions made on behalf of low income earners. The offset will be capped at $500.

The LISTO will apply to fund members with adjusted taxable income up to $37,000 that have had a concessional contribution made on their behalf.

This measure is to ensure that low income earners do not pay more tax on savings placed into superannuation than on income earned outside of superannuation.

The measure essentially extends the operation of low income superannuation contribution (LISC), which is set to expire on 30 June 2017, under another name.

Division 293 threshold will be reduced

From 1 July 2017, the Division 293 threshold will be reduced from $300,000 to $250,000. This threshold is the point at which high income earners pay additional 15% contributions tax on concessional contributions.

This measure is designed to improve sustainability and fairness in the superannuation system by limiting the effective tax concessions provided to high income individuals.

Pension phase measures

Introducing a new $1.6 million superannuation transfer balance cap

The Government will introduce a $1.6 million transfer balance cap on the total amount of accumulated superannuation an individual can transfer into the retirement phase. This cap will take effect on 1 July 2017.

Subsequent earnings on these balances will not be restricted.

Where an individual accumulates amounts over $1.6 million, they will be able to maintain this excess amount in an accumulation phase account, where earnings will be taxed at 15%.

This cap will limit the extent to which the tax-free benefits of retirement phase accounts can be used by high wealth individuals. It will effectively force funds in excess of $1.6 million either to remain in accumulation phase with investment earnings taxed at 15% or to be taken out of superannuation system completely if members wish to do so.

For example, Asha had accumulated a superannuation balance of $2.2 million. She can start an account-based pension with a maximum of $1.6 of her balance. The remaining $600,000 will have to remain in an accumulation phase or be taken out as a lump sum.

Further, suppose that she transferred a maximum $1.6 million amount of her balance into the pension phase and commenced an account-based pension. This balance was very well invested and after taking the required minimum pension, investment earnings for the financial year were $200,000. This brings Asha’s pension phase balance to $1.8 million solely because of the investment earnings. This is fine because subsequent earnings on pension phase balances are not affected by the $1.6 million cap.

Members already in the retirement phase with balances above $1.6 million will be required to reduce their balance to $1.6 million by 1 July 2017. Excess balances may be converted to superannuation accumulation phase accounts.

Transferred amounts exceeding the $1.6 million cap (including earnings on these excess transferred amounts) will be taxed, similar to the tax treatment that applies to excess non-concessional contributions.

The amount of cap space remaining for a member seeking to make more than one transfer into a retirement phase account will be determined by apportionment.

Commensurate treatment for members of defined benefit schemes will be achieved through changes to the tax arrangements for pension amounts over $100,000.

The Government will undertake consultation on the implementation of this measure.

GEM Capital Comment

This proposal will allow couples to have a combined pension balance of up to $3.2 million. However, where most of a couples superannuation savings are in one spouses name the $500,000 lifetime non-concessional cap will restrict a couple's ability to equalise their benefits to take full advantage of the transfer balance cap.

The requirement for member's with balances already in excess of $1.6 million to either withdraw or transfer the amount in excess of the cap back to superannuation (accumulation phase) means that people with pension account balances in excess of $1.6 million have not been grandfathered from these changes.

In this case, this may also result in impacted memebers with Self Managed Super Funds or super wrap accounts disposing of assets prior to transferring back to accumulation so as to ensure any capital gains are crystalised while the assets are still in pension phase and exempt from tax.

Transition to Retirement Income Streams (TTR): removing the tax exemption and an ability to treat pensions as lump sums in certain circumstances

The Government will remove the tax exemption on earnings of assets supporting Transition to Retirement Income Streams (TTR) from 1 July 2017.

Currently, earnings on superannuation balances that support a TTR pension are exempt from income tax of 15% applicable to investment earnings in the accumulation phase.

The Government will also remove a rule that allows individuals to treat certain superannuation income stream payments as lump sums for tax purposes.

These measures are expected to remove the attractiveness of TTR pensions as a tax planning device.

GEM Capital Comment

Taxing earnings on TTR income streams significantly reduces the tax effectiveness of strategies such as TTR and salary sacrifice. For clients aged 60 or over, TTR strategies may still be worthwhile as pension payments are tax free and allow tax effective salary sacrifice contributions. However for clients under age 60, the tax benefits are minimal.

The taxation of earnings in pension phase will only apply to "Transition to Retirement' income streams where the client has reached preservation age but not yet retired. Presumably income streams where the client has met a full condition of release such as retirement will continue to have the earnings tax exemption apply. Clients may look at arrangements involving ceasing a gainful employment arrangement over age 60 or ceasing work and declaring permanent retirement to meet the retirement condition of release.

From a superannuation fund perspective, administering the taxation of earnings in pension phase for transition to retirement pensions will add complexity.

Superannuation death benefits: removing the anti-detriment provision

From 1 July 2017, the anti-detriment provision will be removed.

The anti-detriment provision can effectively result in a refund of a member’s lifetime super contributions tax payments into an estate, where the beneficiary is the dependant (spouse, former spouse or child) of the member. According to the Government, currently this provision is inconsistently applied by super funds.

Removing the anti-detriment provision will better align the treatment of lump sum death benefits across all super funds and the treatment of bequests outside of super.

Lump sum death benefits to dependants will remain tax free.

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. We strongly suggest that no person should act specifically on the basis of the information contained herein, but should obtain appropriate professional advice based upon their own personal circumstances including personal financial advice from a licensed financial adviser and legal advice. Fortnum Private Wealth Pty Ltd ABN 54 139 889 535 AFSL 357306