The daily gyrations in the Afterpay share price recently has given investors motion sickness. In the light of new information ranging from the Austrac investigation, to Visa announcing a competitive threat, Afterpay investors have been re-examining the investment case. Here we outline some of the thinking from 3 professional investors on this ASX top 100 company.

Afterpay has changed the habits of millennial spenders who prefer to pay in instalments mostly with debit cards to avoid the punitive interest rates and application process of credit cards. Afterpay users purchase goods upfront and pay for them in 4 instalments, but the retailer receives the funds upfront from Afterpay. The consumer doesn’t pay interest on the transaction.

Afterpay makes its money from charging retailers a merchant fee based on the transaction size. Although Afterpay can charge a late fee in the event of a failure to repay the outstanding amount, the majority of Afterpay’s revenue comes from merchant fees.

“Retailers love Afterpay as average purchase size increases” according to Nathan Bell, Intelligent Investor.

Bell believes that the Austrac issue is of little long-term consequence, even under a worst case scenario.

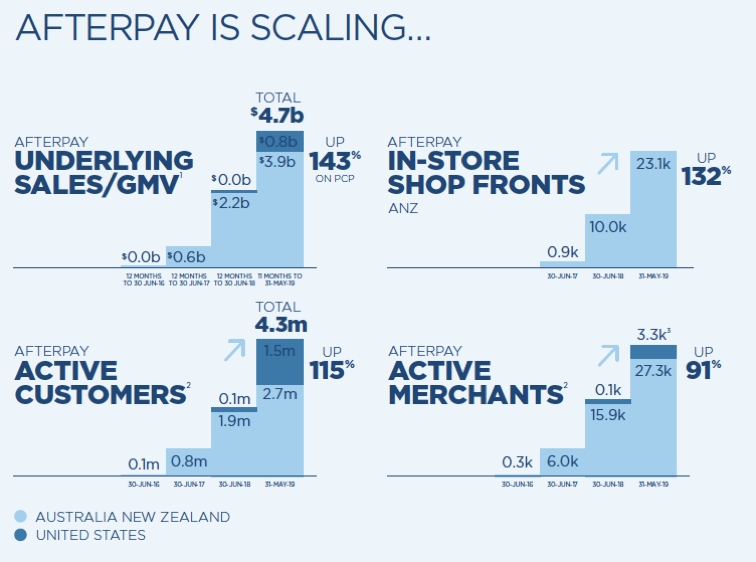

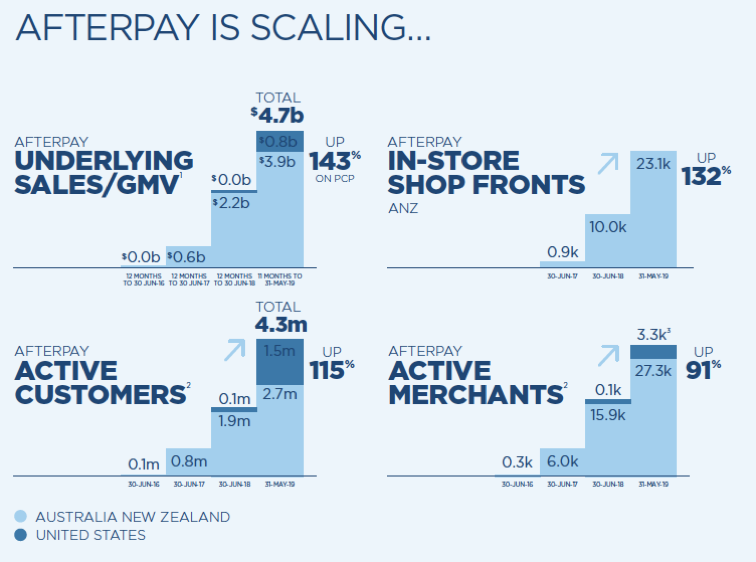

Andrew Mitchell, Senior Portfolio Manager, Ophir Funds Management was one of the first institutional investors in Afterpay and says that while Australia now boasts 2.5m active Afterpay users since starting 4 years ago, “this is a sideshow to the real opportunity lying offshore with the US market approximately ten times the size and the UK market around three times larger. Early signs are positive in the US where the monthly rate of customer signups has been higher than the experience in Australia with already over 1.5m active users after just 12 months.”

Late last year when Afterpay’s share price was under intense pressure, Mitchell travelled to the US to speak with retailers personally. When he discovered the surging take up rate of Afterpay by several leading US retailers, Ophir doubled their position. Afterpay recently confirmed that they have 4,400 retail partners in the US.

Nathan Bell thinks that Afterpay collecting so much data on spending habits could also lead to new services. In a wildly bullish scenario he says, Afterpay could eventually have much more in common with a bank than it does today.

Michael Glennon, Glennon Capital is of the view that by being the first to the market does offer the company an advantage. “The best case for Afterpay is that it becomes a globally recognised brand like American Express” he says. He thinks management is doing a good job and while Visa announced plans to enter the buy now pay later space he adds “these people (Afterpay) have got it right, I’m not sure Visa will get it right”.

Some broker research is dismissive of the threat from Visa as 80% of people using Afterpay don’t have a credit card, and instead use a debit card. Glennon says that while the threat from Visa may not be in itself company changing, it does tell investors that “if Visa are looking at Afterpay, then you can bet others are too”.

Other risks to the Afterpay business according to Andrew Mitchell include ensuring responsible lending to consumers is adhered to, changes to regulatory framework governing the buy now pay later industry and a material increase in bad debts.

Nathan Bell adds “there have been several governance issues, and the founders have been selling large amounts of shares. This is typically a big red flag, but I would sell some shares at the current price too if I was them.”

The big elephant in the room is valuation. While rapid revenue growth is assured given its early success in the US, Afterpay must continue to grow sales quickly to justify a forecast market value to sales ratio of around 10x revenue based on 2021 estimates. Those investors with grey hair will recall that the last time the market priced businesses on a price to sales basis (rather than price to earnings) was during the dot.com boom.

Future growth in the US could of course justify the lofty valuation, but investors would be wise to closely monitor the US rollout.

This article is general advice only. The author does not own shares in Afterpay. This was published in the Australian Financial Review during the month of July 2019.