Every bull market has it's pin up boy. In the early 2000's, it was the technology stocks where we witnessed companies 'reinventing' themselves by adding .com to their name, accompanied by large share prices increases.

Every bull market has it's pin up boy. In the early 2000's, it was the technology stocks where we witnessed companies 'reinventing' themselves by adding .com to their name, accompanied by large share prices increases.

Today, the Technology companies that are rising rapidly are underpinned by significant growth in revenue and profits, something that was missing from much of the tech sector early this century.

But there is a new 'Next Big Thing' that is attracting investment, probably from many who have not seen market cycles before, or fads come and go. We are of course referring to Crypto currencies, led by Bitcoin.

At this point we wish to make the point that when discussing crypto currency it is important to separate the technology behind crypto currency from the currency itself.

The technology behind Bitcoin and other crypto currencies, known as Blockchain, is real and likely to influence the financial system around the world as banks, stock exchanges and share registries are investing heavily in the technology. Put simply “The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.”

Picture a spreadsheet that is duplicated thousands of times across a network of computers. Then imagine that this network is designed to regularly update this spreadsheet and you have a basic understanding of the blockchain.

Information held on a blockchain exists as a shared — and continually reconciled — database. This is a way of using the network that has obvious benefits. The blockchain database isn’t stored in any single location, meaning the records it keeps are truly public and easily verifiable. No centralized version of this information exists for a hacker to corrupt. Hosted by millions of computers simultaneously, its data is accessible to anyone on the internet.

So the technology behind Bitcoin and others is real and is likely to materially impact the global financial system, particuarly to reduce processing costs and times and 'cut out the middle man'.

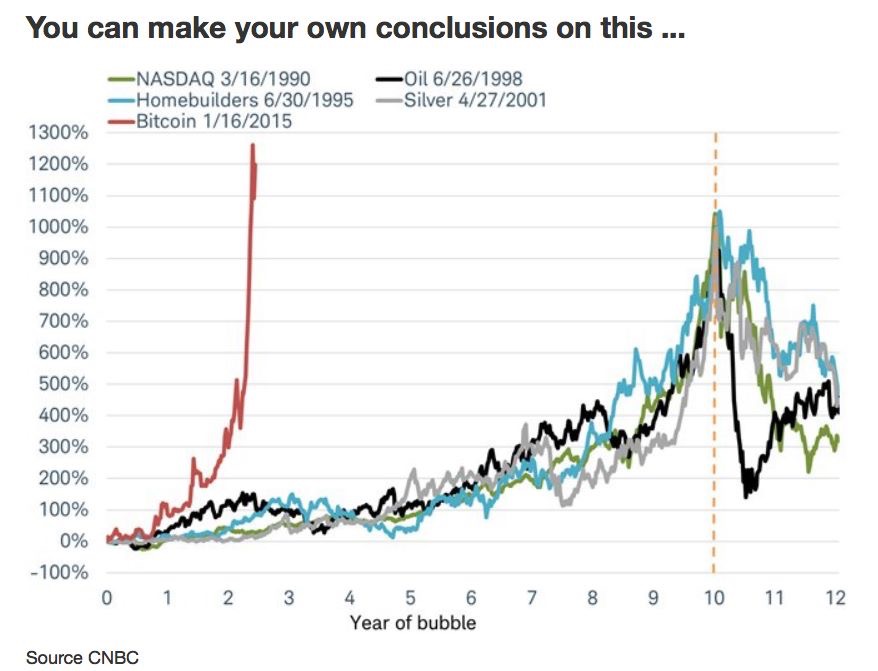

Our concern in this article revolves around the trading of Bitcoin and other crypto currencies by those seeking to get rich quickly. The chart below tracks the rise of some of history's great bubbles, including Bitcoin.

What prompted us to write about this is when I began seeing a friend of mine uploading a Bitcoin market report everyday on Facebook and scoffing at those who invest in "old world" sectors like fixed interest and the share market. I can remember these type of conversations during the tech boom of early 2000's.

We are not professing to be experts on Bitcoin, or cryptocurrencies, we simply wish to highlight the issues that we would want to satisfy ourselves with before investing. You can then make your own conclusion.

Cryptocurrency is a form of digital money that is designed to be secure and, in many cases, anonymous, making it ideal for money laundering, organised crime and drug/arms dealers.

It is a currency associated with the internet that uses cryptography, the process of converting legible information into an almost uncrackable code, to track purchases and transfers. There are new cryptocurrencies being issued every week, and these are known as Initial Coin Offerings.

It is being suggested by enthusiasts that cryptocurrency will become the global currency benchmark, replacing paper money and the existing financial system. We would caution against such a view as one of the key differences between cryptocurrency and say $USD, is that there is a Government standing behind the $USD. So unless the Government were to default, the currency has value. There is no Government support behind cryptocurrency. In fact recently the Chinese Government announced that public cryptocurrency exchanges would be shut down.

Our other questions include:

1. Why are cryptocurrencies not being embraced by larger insitutional investors, often referred to as 'smart money'?

2. What legal protections are available to investors who trade cryptocurrency in the event of fraud or other online mischief?

3. What is the intrinsic value of what investors are buying? (ie the intrinsic value of buying a company is the future cash flow a company generates)

We leave this article quoting two famous investors (made famous for different reasons).

Jordan Belfort, the original "Wolf of Wall Street" says that initial coin offerings "are the biggest scam ever" and "are far worse than anything I was ever doing".

Howard Marks, one of the worlds most famous investors, from Oaktree Capital talked about cryptocurrencies in his recent investor newsletter. His word of caution was "They're not real".