When there is a fall in the market investors are bombarded by opinions from ‘experts’ speculating on how far markets will fall. These experts are currently debating how far interest rates will rise and whether or not we enter recession.

Recession is defined as ‘a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters’. Investors need to appreciate that periods of recession are a normal part of the business cycle and for investors reasonably positioned, are temporary in their effect.

Hugh Dive who is the chief investment officer at Atlas Funds Management believes that the chances of Australia slipping into recession are much lower than the USA and Europe due to the different composition of our economy, minimal direct impact from the Ukraine war (in fact several sectors are benefitting), lower inflation which should reduce the need for the RBA to raise interest rates as hard as some expect.

Dive cites strength in the labour market as a key indicator for investors to watch with the ANZ Job Ads currently the strongest it has been in over a decade. Typically recessions are accompanied by high unemployment. During the 1982-83 recession the unemployment rate peaked at 10.5% and in the 1991-1992 recession the unemployment rate peaked at just over 11%.

Dan Moore portfolio manager at Investors Mutual points out the current rate of unemployment in Australia is 3.5%, the lowest it has been in over 45 years which is likely to be as good as it gets. Moore says that other indicators including rising interest rates and relatively high inflation, at least in the short term, point to more difficult economic conditions.

The key question for investors right now is whether they should sell everything and move to cash, or stay invested in the markets.

To some, during periods of market stress the least risky option appears to be for investors to sell everything and move to cash.

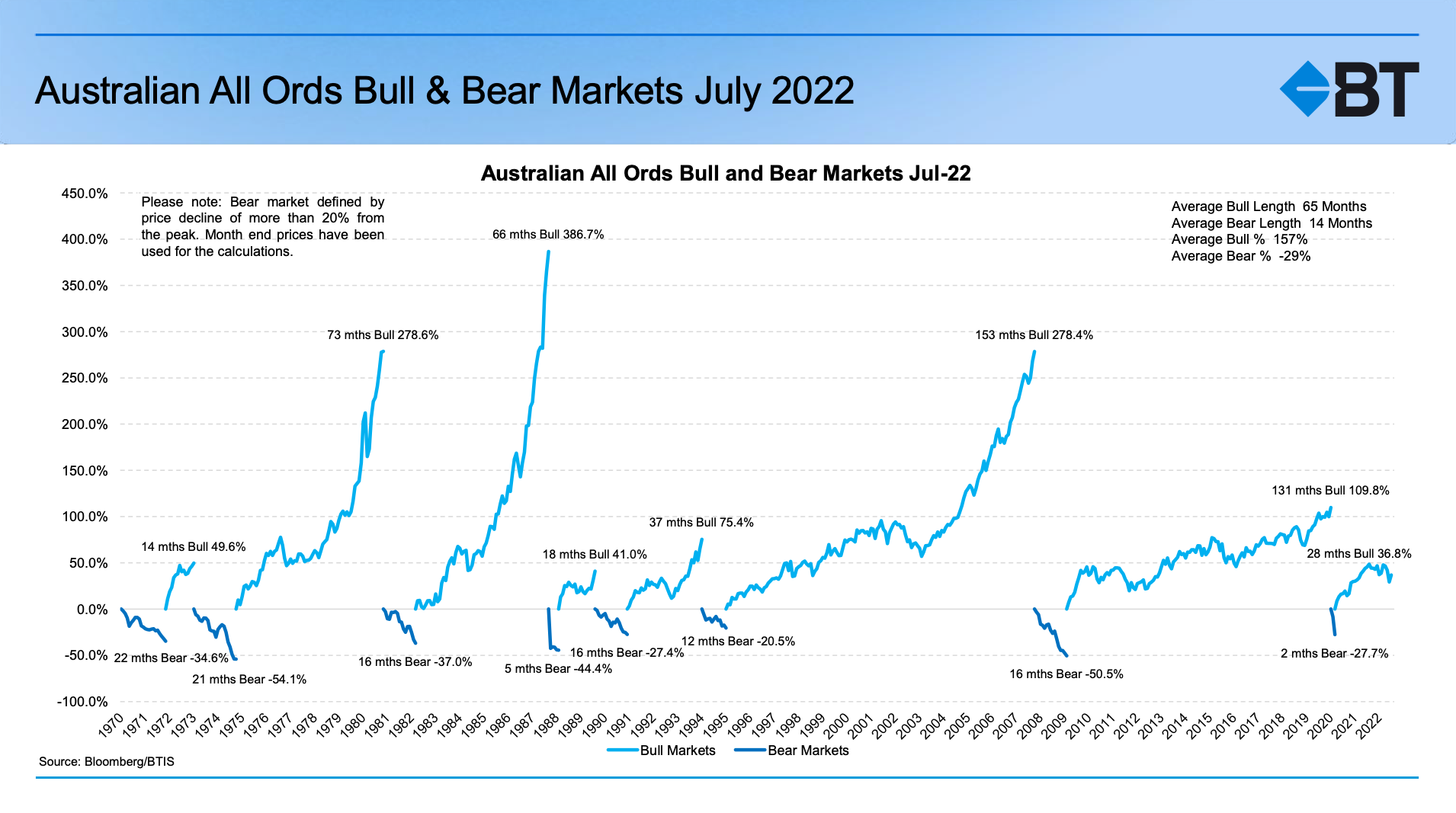

History however shows a different story for those who sell during a downturn and miss out on the rebound when it occurs. The average bear market in Australia declines 29% and lasts 14 months, versus the average bull market rising by 157% and lasting 65 months. For reference, the Australian market last peaked in August 2021.

Dive believes that successfully timing the market both to exit at the top and re-enter at the bottom is beyond the ability of virtually all investors, a feat not managed by even the most exalted fund managers. In early 2020 a few fund managers were patting themselves on the shoulder for reducing their equity exposure early on in the pandemic. These same fund managers spent the remainder of 2020 and 2021 holding too much cash, cursing the fast recovery and missing out on gains.

Dive points out that famed investor Jeremy Grantham received positive press for calling the major bubbles of 2000 and 2007. However Grantham famously predicted doom for equity markets in 2010, 2011, 2012, 2013, 2014, 2015, 2017 and 2021. Those who predict gloom regularly, will look like a genius every few years, but if an investor had heeded these calls, they would have been sitting in cash, earning a negative real rate of return for most of the past decade.

Moore highlights that selling for market timing purposes gives an investor two ways to be wrong. The decline may or may not occur, and if it does, you’ll have to figure out when the time is right to reinvest.

There is no doubt that investors face a challenging set of circumstances which include rising interest rates, high inflation, China’s COVID zero policy and the Ukraine war.

To navigate the current environment, Moore suggests investors be conservative and seek high quality investments. He defines high quality investments as those with recurring revenues, strong balance sheets (ie not too much debt), capable management and businesses with a strong competitive advantage. Brambles, Aurizon and Amcor are examples of such businesses according to Moore.

Dive says that during high inflation periods investors must seek companies with the ability to pass on higher costs to their customers. The recent company reporting season showed companies such as ASX and Woolworths inability to pass through higher costs, whereas Amcor and Transurban passed through increased costs to maintain profit margins.

Tough times don’t last, tough investors do.

Mark Draper (GEM Capital) writes for the Australian Financial Review each month and this article was published on 5th October 2022