With official interest rates hovering at 3.5% and residential property income yields typically running at between 4-5%, investors are clamouring for investments that pay a higher rate of income.

Is it as simple as running a ruler over the dividend yield column in the Financial Review to select your investments?

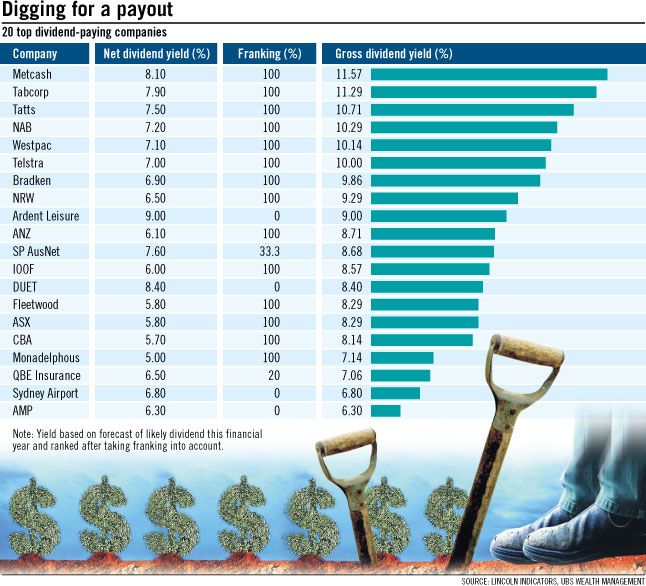

The table below highlights the top 20 dividend payers from the Australian share markets based on forecast dividend payments for the current financial year.

What are some of the questions investors should ask themselves when considering high income investments?

What is the likely profit growth trend that can support future dividends?

What proportion of company profits are being paid out as dividends? A high proportion doesn't leave the company much room to maintain dividends if profit drops.

Is the dividend being artificially inflated by asset sales, debt or financial engineering?

What is the outlook for the sector in which the company operates within?

These points are best illustrated comparing the highest ranking dividend payer in the chart above, Metcash with its larger rival Woolworths. Woolworths dividend is not as high as Metcash but the share price chart below shows that Woolworths has been a better performing investment despite paying a slightly lower dividend. (Woolworths is the blue line and Metcash the red line)

Woolworths vs Metcash Share Price Performance

There is no doubt there are some juicy dividends to be enjoyed by investors in the current market, but care must be taken to avoid what is referred to as a value trap. (where an investment appears good value - but performs as a dog) We encourage investors to look beyond the headline dividend yield when considering an investment.

This material has been provided for general information purposes and must not be construed as investment advice. This material has been prepared without taking into account the investment objectives, financial situation or particular needs of any particular person. Investors should consider obtaining professional investment advice tailored to their specific circumstances prior to making any investment decisions and should read the relevant Product Disclosure Statement.