Key points

- After much talk since May, the US Federal Reserve is finally reducing (or tapering) its asset purchase program - by $US10bn a month.

- However, the Fed has enhanced its very dovish forward guidance, highlighting that interest rate hikes are still a long way off and dependent on the economy.

- Fed policy remains market friendly & generally supportive of further gains in shares.

- While, Fed tapering and speculation around it has and will contribute to bouts of market uncertainty, it should be seen as good news as it indicates the US recovery is becoming more sustainable.

Introduction

In what was perhaps the most anticipated event this year the US Federal Reserve has announced it will reduce the pace of its third quantitative easing (QE3) program by $US10bn a month. The Fed has been foreshadowing a “tapering” since May 22nd so it’s a surprise to no one. This note looks at what it means for US monetary policy and investment markets.

The Fed tapers

The key aspects of the Fed’s decision to taper are:

- A cutback in QE from $US85bn a month to $US75bn.

- This to be focussed on both reduced Treasury bond purchases (which drop from $US45bn a month to $US40bn) and reduced purchases of mortgage backed securities (which drop from $40bn a month to $35bn).

- Tapering is not a “not on a preset course” but dependent on further economic improvement & higher inflation with Chairman Bernanke implying the wind down will be such that QE will likely continue into late next year, implying an ongoing reduction of about $US10bn in bond purchases each meeting, which is slower than many expected,

- More dovish guidance on the outlook for interest rates with the Fed indicating rates will remain near zero well beyond the time when unemployment falls below 6.5% and 12 of the 17 Fed committee officials not seeing a rate hike until 2015. In other words the clear message is that tapering is not monetary tightening and does not mean that the first rate hike is any closer.

The Fed’s dovish guidance is significant as Fed research suggests it has greater effects on the economy than signals about asset purchases.* Specifically, it’s aimed at pushing back against rising bond yields as it has led to higher mortgage rates.

Our assessment

The first thing to note is that the Fed’s move is positive as it indicates the US economy is getting stronger and the recovery more self-sustaining and so the US can start to be gradually taken off life support. However, the emphasis is on gradual. It’s quite clear the Fed is still committed to easy monetary policy until more spare capacity is used up. While the economy is on the right path, it’s still got a way to go, particularly with inflation running well below the Fed’s 2% target.

In this regard, tapering is not the same as monetary tightening. Pumping cash into the US economy is continuing but at a slightly lower rate. It’s very different to the premature and arbitrary ending of QE1 in March 2010 and QE2 in June 2011 that went from $US95bn & $US75bn respectively in monthly bond purchases to zero overnight at a time when US and global economic data was poor and contributed to 15-20% share market slumps at the time. This time around QE is only being reduced gradually and only because the economic data shows the US economy improving.

More fundamentally, tapering does not signal earlier interest rate hikes. Quite clearly the Fed has gone out of its way to stress this message by indicating that near zero interest rates will likely remain well beyond the time when unemployment falls below its previous target of 6.5%. Our own view of the US economy is very similar to the Fed’s in seeing growth of around 3% next year driven by housing, business investment and consumer spending. However, barring a much faster acceleration in growth, interest rate hikes are still probably 18 months or more away:

- Growth is still far from booming.

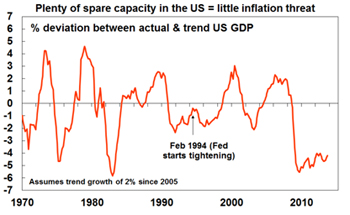

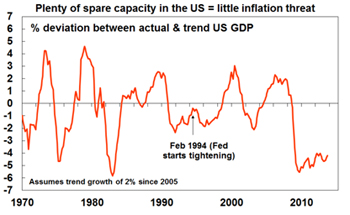

- Spare capacity is immense as evident by 7% official unemployment, double digit labour market underutilisation and a very wide output gap (ie the difference between actual and potential GDP).

Source: Bloomberg, AMP Capital

- A fall in labour force participation has exaggerated the fall in the unemployment rate. While much of this is structural some is cyclical and at some point will start to bounce back slowing the fall in unemployment.

- Inflation is low at just 1.2%.

Comments during her nomination hearings quite clearly indicate that Janet Yellen, the likely next Fed Chairman after Bernanke’s term ends at the end of January, will not be rushing to raise interest rates.

Put simply the Fed may be easing up on the accelerator, but they are a long way from applying the brakes.

Finally, while the US is slowing its monetary stimulus this is not so in other key developed regions with both the ECB and Bank of Japan likely to ease further if anything.

Implications for investors

While the days of expanding US monetary stimulus are probably over, the message from the Fed remains market friendly. The pace of quantitative easing is slowing only gradually, this is contingent on the US economy continuing to strengthen and rate hikes are unlikely until 2015, at least.

For sovereign bonds our medium term view remains one of poor returns. Despite the back up in yields, they remain low relative to long term sustainable levels suggesting the risk of rising yields and capital losses over time as the global economy mends. Even if bond yields stay flat at current levels they offer poor returns, eg just 2.9% for US 10 year bonds and just 4.3% for Australian ten year bonds. However, a 1994 style bond crash which saw extreme long bond positions unwound triggered by a sharp 300 basis point rise in the US Fed Funds rate looks unlikely.

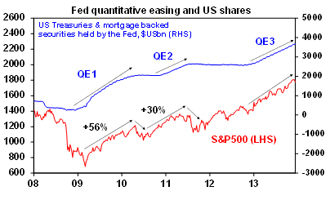

For shares, the period of dirt cheap share markets and support from ever expanding monetary stimulus seems over. More significantly, taper talk since late May has clearly made some nervous given the positive relationship between rounds of quantitative easing in the US and share markets, with many fearing that a move to end it will be followed by slumps as occurred after QE1 and QE2 ended. See the next chart.

Source: Bloomberg, AMP Capital

Slowing QE suggests share market returns are likely to slow from the 20% or so pace of the last 18 months. Bouts of uncertainty regarding the Fed’s intentions are also likely, as we saw in May-June and more recently. However, the overall picture remains favourable for shares:

First, the tapering of QE3 is very different to the abrupt and arbitrary ending of QE1 and QE2. This time around US data is stronger and the wind down in QE3 is dependent on further improvement in US economy.

Second, although the Fed isn’t undertaking monetary tightening many tend to see it as such so past monetary tightening moves, which have been via rate hikes, are instructive. The next table shows US shares around the first rate hikes in the past 8 Fed tightening cycles. The initial reaction after 3 months is mixed with shares up half the time and down half the time. But after 12 and 24 months a positive response tends to dominate. So even if this were the start of a monetary tightening cycle it’s not necessarily bad for shares.

The reason for this lies in the improvement in growth and profits that normally accompanies an initial monetary tightening. It’s only later in the cycle when rates are going up to onerous levels to quell inflation that it’s a worry. Right now we are seeing improving growth and profits, but with the start of rate hikes (let alone rises to onerous levels) looking a long way off given very low inflation.

US shares after first Fed monetary tightening moves

| First rate hike | -3 mths | +3 mths | +6 mths | +12 mths | + 24 mths |

| Oct 80 | 4.8 | 1.6 | 4.2 | -4.4 | 2.4 |

| Mar 84 | -3.5 | -3.8 | 4.3 | 13.5 | 22.5 |

| Nov 86 | -1.5 | 14.0 | 16.4 | -7.6 | 4.8 |

| Mar 88 | 4.8 | 5.6 | 5.0 | 13.9 | 14.6 |

| Feb 94 | 2.9 | -6.4 | -4.9 | -2.3 | 14.9 |

| Mar 97 | 2.2 | 16.9 | 25.1 | 45.5 | 30.3 |

| Jun 99 | 6.7 | -6.6 | 7.0 | 6.0 | -5.6 |

| Jun 04 | 1.3 | -2.3 | 6.2 | 4.4 | 5.5 |

| Average | 2.2 | 2.4 | 7.9 | 8.6 | 11.2 |

Source: Thomson Reuters, AMP Capital

Thirdly, the rally in US shares recently has been underpinned by record profit levels. It’s not just due to easy money.

Finally, shares are likely to benefit from long term cash flows as the mountain of money that has gone into bond funds since 2008 is gradually reversed with some going to shares.

Source: ICI, AMP Capital

While next year will no doubt see a few corrections in shares along the way, the key point is that the broader picture – of reasonable share market valuations, improving global growth and still very easy monetary conditions - suggests the bull market in shares has further to run.

The Australian share market is also likely to benefit from the rising trend in global shares, but is likely to remain a relative underperformer reflecting better valuations globally and a bit more uncertainty over the Australian economy. Sector wise, mining stocks look cheap and best placed to benefit from the global recovery.

In terms of the Australian dollar, Fed tapering may make life a bit easier for the RBA in getting the $A down. While I wouldn’t get too excited as near zero interest rates in the US look like remaining in place for some time, the broad trend in the $A is likely to remain down.

Finally, in the very short term getting the Fed’s taper decision out of the way likely clears the way for the seasonal Santa rally in shares that normally gets underway around this week and runs into early January.

Dr Shane Oliver

Head of Investment Strategy and Chief Economist

AMP Capital

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.