Late last year OPEC announced that it will cut oil production by 1.2 million barrels per day to 32.5 million. To put this number in perspective, OPEC represents around one third of global oil production. These cuts will take effect in January 2017, lasting for 6 months and is the first time since 2008 that OPEC has cut production. Currently although Iraq is producing more than agreed, the compliance from other OPEC members has been very high.

Already there has been some reaction in the oil markets with the price of oil rising in the last quarter of 2016.

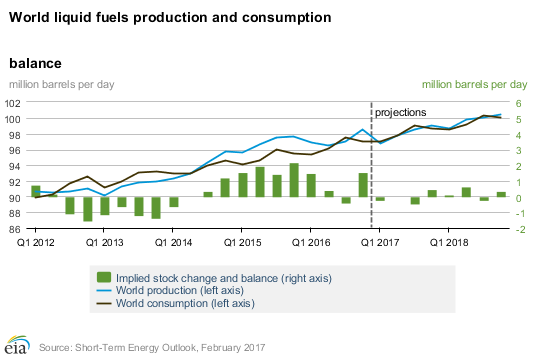

Around 12 months ago, we shot a video featuring Clay Smolinski (Platinum Asset Management) who suggested that the oil markets would likely come into balance where supply meets demand during 2017. This of course was well before the OPEC production cuts were announced, as the balancing of the oil market was underway at that stage. The OPEC production cuts simply speed up the process. The graph below confirms his prediction.

What stands out from the above chart is how close supply and demand tend to be. Even when the oil market was in dramatic oversupply during 2015, the oversupply was around 2 million barrels per day. The over-supply gap at the end of 2016 was small which underscores the significance of a production cut of 1.2m barrels per day.

It was also suggested at that time, that the oil price was likely to recover to around $70 per barrel as it is at this level that oil companies can make sufficient profit to reinvest into exploration to ensure supply can be maintained. Currently the oil price remains in the $50 - $55 per barrel range, but the production cuts, providing they are maintained are only starting to be reflected in oil inventories now.

Higher oil prices are positive for companies who derive income from oil or products referenced to the oil price such as LNG.

At GEM Capital we have been investing in companies that can benefit from a rising oil price, and with fund managers who also share this view such as Ausbil and Platinum Asset Management.