GEM Capital has considered applying for stock in the soon to be listed Inghams IPO, and had the opportunity through its investment bank contacts, but have decided not to proceed after careful consideration.

GEM Capital has considered applying for stock in the soon to be listed Inghams IPO, and had the opportunity through its investment bank contacts, but have decided not to proceed after careful consideration.

This article is simply to communicate the evaluation process that is undertaken when assessing investment opportunities.

Inghams is one of the largest vertically integrated chicken manufacturers in ANZ with a #1 market share in Australia (40% share) and #2 in New Zealand (34% share). Inghams runs its own stockfeed operations and controls every aspect of chicken growing and processing. Its closest competitor has a 33% market share in Australia and 48% in NZ.

Inghams Group sells to supermarkets (53% of revenue), fast food restaurants (17% of revenue), food distributors (8% of revenue), and ‘wholesale’ providers (butchers, etc, 7% of revenue). Although Inghams has a large number of customers, the top five accounted for 55%-60% of revenue in 2016. We have seen with companies like Coca-Cola Amatil Ltd that large supermarkets like Woolworths Limited and Wesfarmers Ltd have the ability to pass on a fair amount of pricing pressure to suppliers and Inghams will not be immune.

One of the most important aspects of assessing a new listing, commonly referred to as an IPO (Initial Public Offering) is to understand who you are buying from. In the case of Inghams, the family has previously sold to a Private Equity firm, TPG Capital. In our experience, rarely do private equity firms pass on gifts to retail investors. (or any investors for that matter)

It is interesting to note that TPG paid the Ingham family close to $900m for the business in 2014, and have since sold all the properties and leased them back, realising around $600m. Now, two years after acquisition, TPG are selling up to 70% of the business to investors and are hoping to raise around $1.1bn at the upper end. That means for an outlay of $900m, TPG will receive up to $1.7bn, pocketing a tidy profit of $800m while still owning 30% of the Ingham business. TPG's remaining 30% stake is escrowed for 6-12 months, but it is unlikely they will be a long term owner of this business.

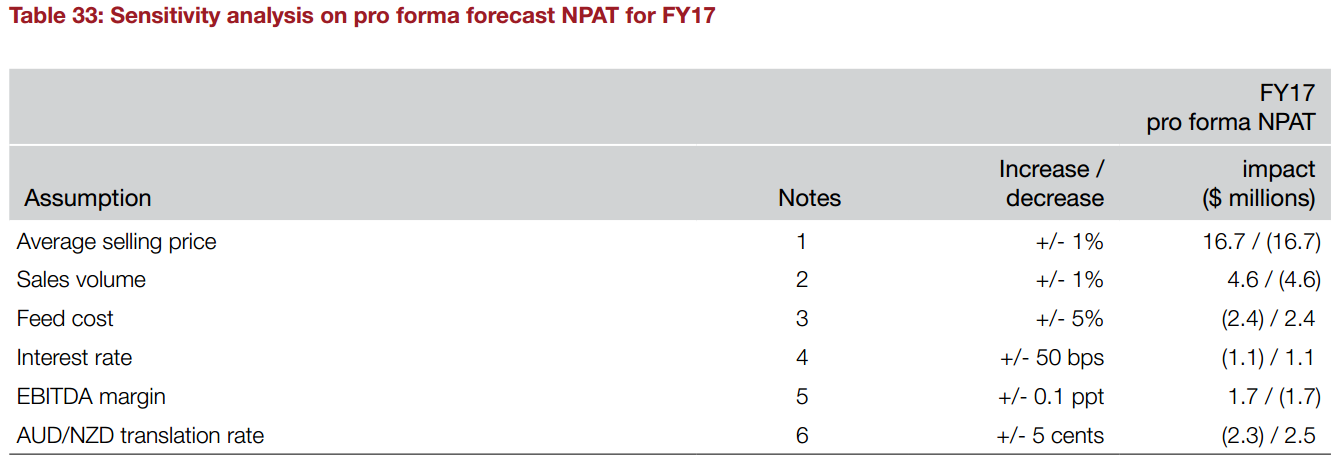

If investors take a look at the sensitivity analysis from the prospectus, they will see that small movements in sales and pricing can have material impacts on profitability.

For a company forecast to increase profit by 18.9% to $98.8m in 2017, movement in average selling prices represents a significant risk should the supermarkets wish to use chicken in a discounting war.

While the price at the upper end of the IPO pricing would appear OK at 15.5 times forecast earnings, the price is higher than its smaller rival across the Tasman, Tegel Foods.

This is a low margin, high turnover business. We don't mind the food production sector and quite like the chicken story, particularly with it's price advantage for consumers over beef.

We just feel that the easy money here has been made by private equity. Therefore we are not participating in the IPO and will watch Inghams in the aftermarket, in the months ahead.

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. We strongly suggest that no person should act specifically on the basis of the information contained herein, but should obtain appropriate professional advice based upon their own personal circumstances including personal financial advice from a licensed financial adviser and legal advice. Fortnum Private Wealth Pty Ltd ABN 54 139 889 535 AFSL 357306