Mark Draper (GEM Capital) wrote this article for the Australian Financial Review and was published during the month of April 2019.

With the graphs of leading Australian economic indicators taking on the shape of a waterfall, investors would be wise to dust off the play book about how to invest in a recession. While not in recession yet, we are likely to know in the next few months whether Australia will enter recession, and it depends on whether some indicators, that we examine here, can change direction.

Many investors have not seen an Australian recession during their investing life, with the last one taking place in 1990/1991. During that recession the economy shrank by almost 2%, employment reduced by just over 3% and the unemployment rate moved into double digits. Business failure rates increased along with bank bad debts, and two of Australia’s major banks were in financial stress with share price falls of at least 30%.

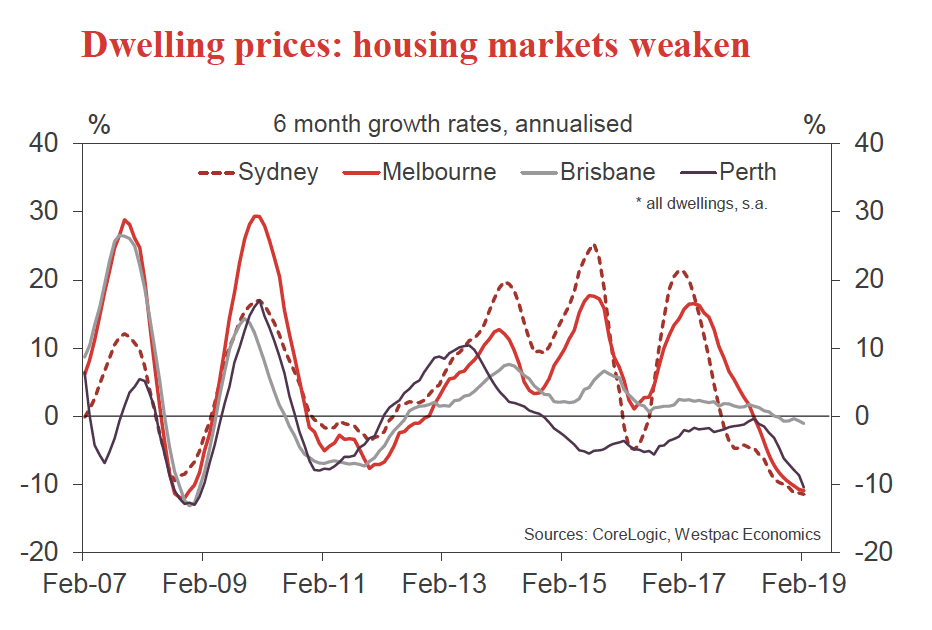

At the epicentre of the current downturn is the residential property market. Property values have been heading south, rapidly, particularly in the eastern states. The further and faster property prices fall, the greater the probability of recession. The IMF believes the downturn is worse than previously thought. This is one of the few times that property prices have fallen without the RBA raising rates or from rising unemployment.

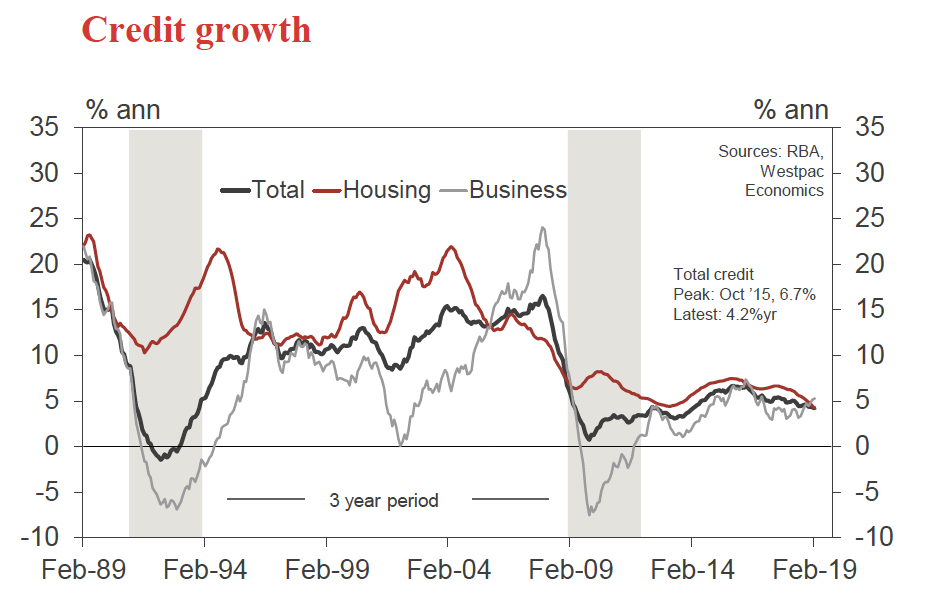

The second key indicator is housing credit growth. Housing credit growth is currently below the level seen during GFC and below the level witnessed during the 1991 recession. Credit approvals are falling, particularly in the second half of 2018. This reflects tightening of lending standards by banks, but also that Australian consumers may have reached their capacity to take on new debt. Investors need to ask what will alter this environment. Previous episodes of weak demand for credit have been met with cuts to official interest rates, but with rates currently at 1.5%, the RBA does not have much ammunition to fire.

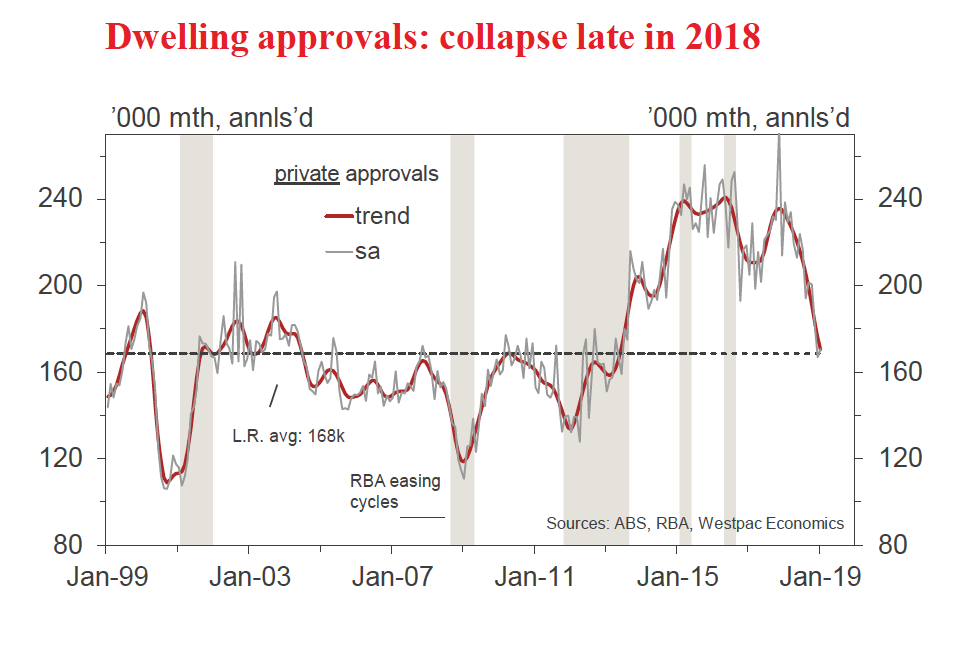

Building approvals are collapsing. While there is currently enough work from buildings currently in progress to keep tradesman busy, building approvals point to a more troubling future.

Falling property values can create a wealth effect where consumers feel less wealthy and as a result defer purchasing decisions. This can be seen in new car sales figures and 2018 saw its worst annual result since 2014. This is against a backdrop of strong population growth during that time.

The weakening economic outlook is unfolding during an election campaign that the ALP are favoured to win. The ALP is proposing to significantly increase the overall tax levied, (ie franking credit changes, CGT and negative gearing changes) which is likely to suck further money out of the economy and act as an additional handbrake.

If Australia were to enter recession, there are several investment sectors where investors should tread carefully.

Given that 60% of the Australian economy revolves around consumer spending, discretionary retailers are most at risk to a consumer under pressure. Caution should also be taken with the price paid for food retailers who may also come under pressure as consumers seek to lower their expenses during a downturn. The recent Woolworths profit result shows the food retailers are already operating in a very difficult retail environment.

Travel is another sector at risk as consumers in a downturn could turn their focus away from discretionary leisure spending. Businesses too could replace interstate travel with more teleconferences in tighter economic times.

Banks are obvious investments to suffer in an economic downturn as demand for credit weakens and bad debts rise.

Property investments with a focus on property development profits should also be scrutinised.

The currency could be one of the few safe havens as the Australian dollar most likely depreciates during recession. Beneficiaries of a weaker currency are those Australian companies who earn income from overseas or unhedged International investments. Australian exporters who have not hedged currency can also benefit from a lower Australian dollar.

Investors should pay attention to the next few months of leading economic indicators to determine whether Australia is likely to break the 27 year recession drought, and position their investments accordingly.