In the last 5 years Telstra shareholders have had little to cheer about as they have watched the NBN punch a hole in earnings, resulting in a share price slide and dividend cuts. That is now changing.

In the recent profit result, not only did Telstra forecast earnings growth for the first time in 5 years, but also outlined a timetable to change its legal structure by splitting the company into 4 parts.

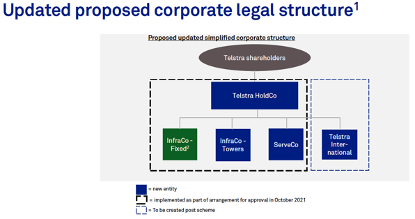

The proposed legal structure within the Telstra Group, expected to be completed by December 2021, includes:

- InfraCo Fixed, which would own and operate Telstra’s passive or physical infrastructure assets: the ducts, fibre, data centres, and exchanges that underpin Telstra’s fixed telecommunications network.

- InfraCo Towers, which would own and operate Telstra’s passive or physical mobile tower assets, which Telstra is looking to monetise given the strong demand and compelling valuations for this type of high-quality infrastructure.

- ServeCo, which would continue to focus on creating innovative products and services, supporting customers and delivering the best possible customer experience. ServeCo would own the active parts of the network, including the radio access network and spectrum assets to ensure Telstra continues to maintain its industry leading mobile coverage and network superiority.

- International, will be established under a separate subsidiary within Telstra Group and includes subsea cables

After being negative on Telstra for years, Gaurav Sodhi (Analyst, Intelligent Investor) believes the new structure is a good move. He says that there are a lot of assets within Telstra that aren’t being adequately valued. Separating them will recognise the value of infrastructure style assets that can generate stable, recurring revenues, resulting in a far higher valuation than the present share price. Sodhi’s sell trigger of $5 on Telstra provides some guidance on the value he sees.

The Towers business carries a modest asset value of just $300m on Telstra’s balance sheet after heavy depreciation. Once towers are in place and connected to the fibre backhaul, they are expensive to replicate and therefore extremely valuable.

Experience overseas shows that Telstra is following a well trodden path as it seeks to increase shareholder value. Will Granger (Analyst, Airlie Funds Management) says that mobile tower companies can trade at EBITDA multiples (earnings before interest, tax, depreciation, amortisation) ranging between 21-27 times earnings. Telstra by comparison currently trades on an EBITDA multiple of around 8 times. Granger believes through a partial or full sell down of these assets, Telstra can realise this valuation arbitrage and increase shareholder returns.

Gaurav supports this view by referencing American Tower which is listed in the US. It is the largest tower business in the world which bought AT&T’s long distance phone lines years ago and used them to host mobile infrastructure and are today valued at over US$100bn. American Tower trades at over 20 times EBITDA while AT&T trades at just 7 times.

Granger adds that Vodafone spun off its mobile tower assets in March of this year on an EBITDA multiple of around 20 times.

Granger sees few downsides for the proposed restructure other than Telstra risking their network advantage if the mobile towers separation is not properly structured.

Sodhi agrees and said that American Tower and Crown Castle have been so successful because they host multiple networks from a single piece of infrastructure. They have been able to scale nicely. For Telstra’s tower businesses to do the same, Telstra would have to allow other networks access to those sites.

There is a clear trade off here. In order to maximise the value of its infrastructure, Telstra needs to allow other networks access to it. If it does that, it risks its network superiority. Sodhi believes that Telstra is likely to opt for a lower value for its infrastructure to protect its network superiority.

The ACCC is another risk to this restructure. Sodhi says that while its been hard to predict the reaction of the ACCC in recent years, he doesn’t believe there would be too many objections. A split of the towers and infrastructure assets potentially opens the door to other networks also utilising those assets which could even the playing field.

Telstra has been a serial underperformer over the past 5 years, but investors must be forward looking and responsive to new information. The split is new and its happening this year, and investors may do well to reconsider Telstra.

This article was written by Mark Draper and appeared in the Australian Financial Review during the month of April 2021.