The only thing certain about the future right now is that the future is uncertain. So as we complete one of the strangest company reporting seasons we have ever seen, investors should reflect on the company profit announcements to see what they can learn about what may lie ahead

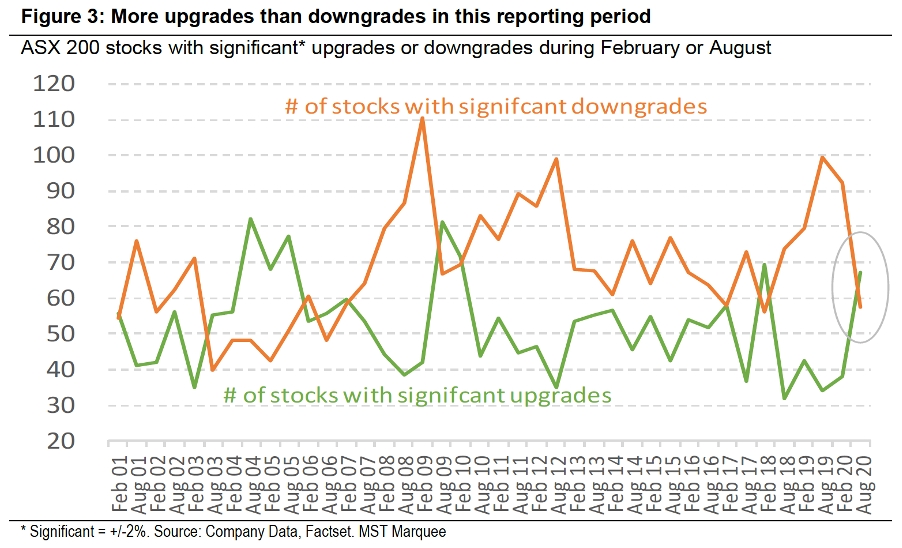

Matt Williams (Portfolio Manager, Airlie Funds Management) says that while overall profits were down 20% compared to the previous year, the dire predictions in late March proved to be too bearish and there are now more profit upgrades than downgrades. He said “The economy has strongly outperformed the accepted bearish scenarios of late March, retailers have produced phenomenal numbers”.

“The COVID-19 pandemic has not been uniformly bad for all Australian companies. Travel related companies and listed property trusts with shopping centre assets have had a tough 6 months, while electrical retailer JB Hifi, hardware and office retailer Wesfarmers, AfterPay and Domino’s Pizza all saw record revenue over the past 6 months, benefitting from consumers being quarantined at home” according to Hugh Dive (Senior Portfolio Manager, Atlas Funds Management).

Nathan Bell (Head of Research & Portfolio Management, Investsmart) picked up on the travel sector which saw airlines and travel retailers at the epicentre of the COVID-19 storm. “You could hear the desperation in Alan Joyce’s voice as he pleaded for state borders to reopen after announcing a $4bn loss”. Bell also highlighted the almost 100% drop in passenger numbers since COVID-19 emerged for listed Sydney and Auckland airports. He is of the view that leisure travel ultimately recovers and even if business travel only recovers to 70% of past highs due to a permanent shift to online meetings, both airports represent good value at current prices. “People are once again going on holidays in the northern hemisphere, which is another good omen for this pair of airports. Vietnam, Taiwan and Korea recently reopened their domestic borders and passenger numbers are now 10 – 20% above 2019 levels, suggesting pent up demand” he adds in support of the investment case for a rebound in airports.

Food and alcohol retailers (such as Woolworths and Coles) reported solid results as they benefitted from changing consumer purchase patterns, but they now trade at huge valuations. Their valuations suggest future returns are likely to be far more muted if not negative should the impact of Job Keeper payments and people raiding their super funds wear off.

Dive points to the fact that “cash flows from the government were a significant feature of the August results season, albeit one that was understandably not highlighted by management when they presented their results. JobKeeper and higher JobSeeker payments have helped companies such as JB Hifi and Afterpay as cash flows from the Government have supported retail sales despite the significant rise in unemployment”. Investors would be wise to resist extrapolating the impact of these Government payments over the past 6 months into the future.

While the Telco sector reported earnings hits from lower global roaming charges and reduced retail sales during lockdowns, the 5G networks will cover the majority of the population in the next 12 months which represents revenue growth opportunities. More rational mobile pricing should also help the Telco’s.

Banks reported much lower profits due to a mix of low credit growth, low interest squeezing margins and increasing bad debts. Bell says of the banks “the bull case for Australia’s largest banks rests on them trading at large premiums to book value despite reporting single digit return on equity figures. If this happens, Australia will be the exception to the rest of the world. We don’t see why Australian banks are an exception as more people deleverage in the years ahead and property investors look beyond property for large capital gains”. Ultimately the loan repayment deferrals will also need to be bought to account as well.

Williams said that in his discussions with company management, the key themes about the future were:

- What happens at the end of the Government stimulus where retailers would appear most exposed.

- Opening up of state borders

- Economic reform

With around 70% of companies either not issuing future earnings guidance or withdrawing earnings guidance, coupled with some market sectors trading on extremely high valuations, the job of assessing investment value is difficult. The best opportunities ahead are less likely to be found in this years’ reporting season stars.

This article was published in the Australian Financial Review during the month of September 2020.