An institutional friend once defined a mine as a "hole in the ground with a liar at the top". While clearly Australia's largest export earners revolve around mining, this remark struck caution into me. There is more to be cautious about with the resources sector and iron ore in particular than a simple throw away line however.

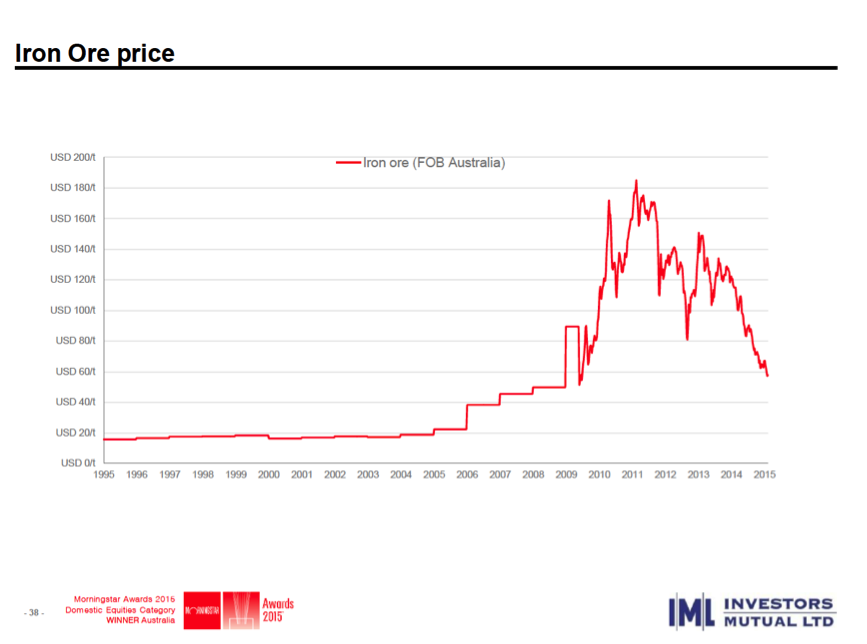

With 60% of world iron ore shipped to China, investors need to consider that the Chinese economy is undergoing change, and its construction and use of steel is slowing. The fundamentals of iron ore supply and demand have changed and has already caused a massive drop in the price of iron ore, which can be seen in the chart below. Just a few years ago the iron ore price was almost $200 per tonne, and now hovers around $60 per tonne (US).

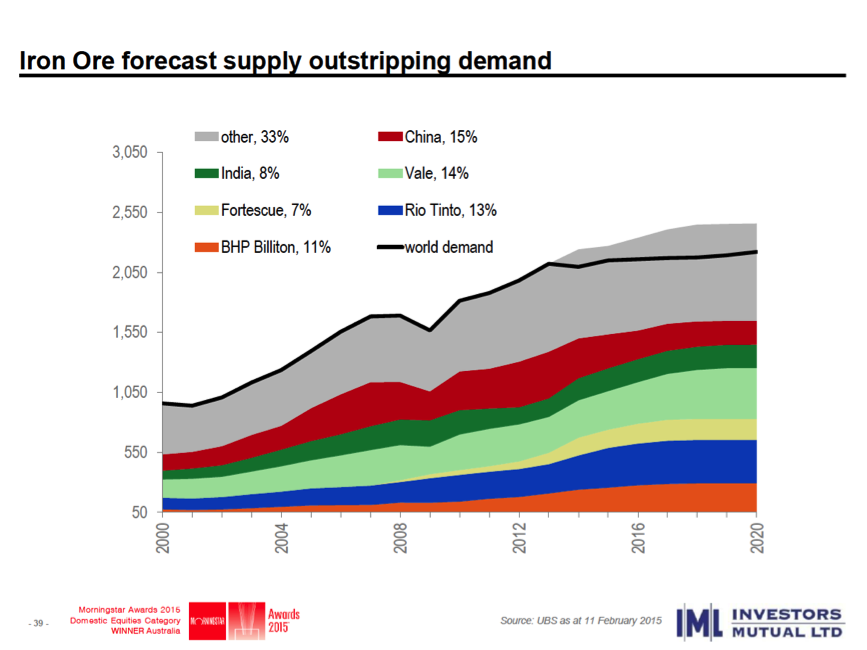

With Chinese demand for iron ore significantly different to that of a few years ago, we have also witnessed a significant uptick in production of iron ore. Slowing demand and rising production has now resulted in an iron ore glut, which obviously has depressed the price. Investors need to ask themselves whether this is likely to rebound quickly or whether lower prices are to remain part of the environment for some time. The graph below forecasts iron ore demand (black line) and overlays iron ore supply from global players. The grey shaded part above the solid line shows the level of oversupply in the iron ore market that is forecast until the end of this decade. It is difficult to see iron ore prices rise given these fundamentals. While BHP and RIO's cost of production remains below $60 per tonne (implying that their production remains profitable), the same can not be said of the small to medium sized players.

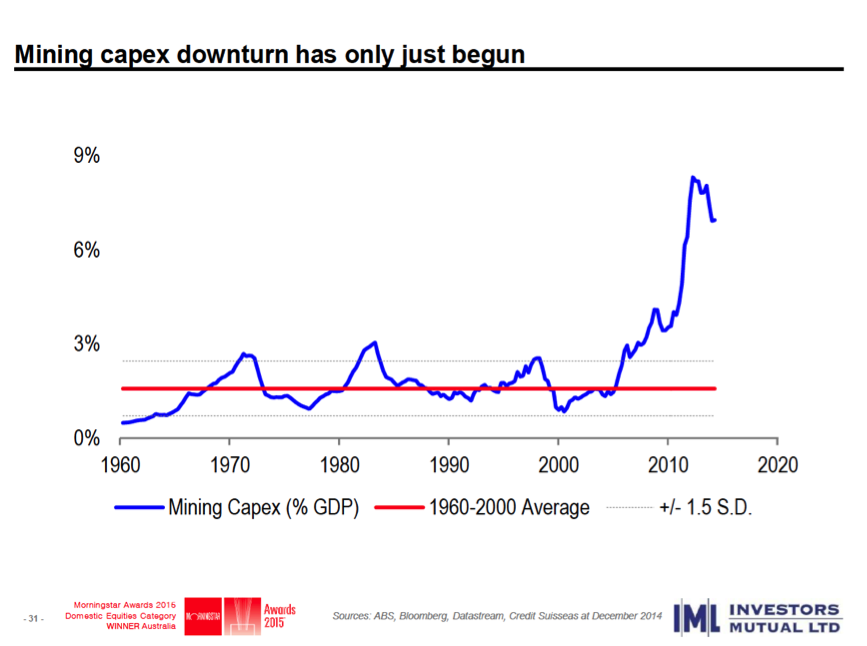

This not only impacts the mining companies themselves as they receive a lower price for their iron ore, but also has the flow on effect on companies that provide services to the mining companies. We are currently witnessing most mining companies cutting costs as their margins are eroded by lower prices and some of the simpler costs to cut involve reducing the expenditure on mining services contractors and other capital expenditure. Australia is also toward the end of completion of several large LNG projects that involve large amounts of capital expenditure, but are likely to complete in the next couple of years. This means that the capital expenditure in the mining sector, which has already come off its all time high, is likely to have further to fall. This is evidenced in the chart below.

So not only are we cautious about owning mining companies themselves, we are also very cautious about investing in companies that provide services to the mining sector. While some of this bad news is clearly already priced in, we are of the view that a catalyst to increase resources prices and stimulate capital expenditure in the mining sector is not on the horizon.

This information is of a general nature only and neither represents nor is intended to be personal advice on any particular matter. We strongly suggest that no person should act specifically on the basis of the information contained herein, but should obtain appropriate professional advice based upon their own personal circumstances including personal financial advice from a licensed financial adviser and legal advice. Fortnum Private Wealth Pty Ltd ABN 54 139 889 535 AFSL 357306