Mark Draper wrote this article which appeared in the Australian Financial Review during the month of December 2018.

After spending the last 20 years despising AMP and selling any shares we ever came into contact with, it is interesting that we find ourselves potentially interested in buying AMP shares now that they are trading at an all time low.

Every investor dreams about picking the turnaround story that doubles in value. Is AMP a two bagger or a falling knife?

It’s hard to find much in the way of positive news flow around AMP at present, which is normally a good place for investors to start as it can imply most investors have already headed for the exits. The recent sale of AMP’s life insurance division was the last instalment of poorly received news with some in the market labelling it a ‘fire sale’ or ‘AMPutation’.

After the sale of AMP’s Life businesses, consensus earnings estimates are around 25 cents per share according to Skaffold software, which puts AMP on a current price earnings multiple of 10.

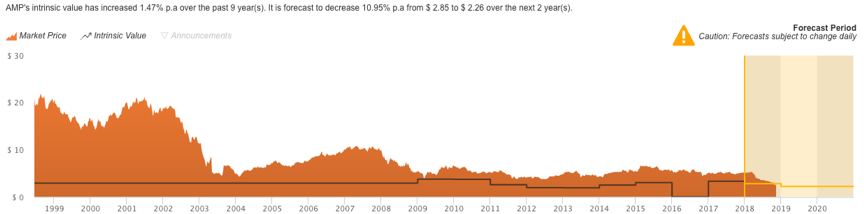

Skaffold which models intrinsic value based on assumptions of future cash flows currently has the share price trading at a small discount to intrinsic value.

Source: Skaffold

What is often overlooked by investors is that AMP still has 3 key divisions, which are Wealth Management (platforms and advisers), AMP Capital (funds management) and AMP Bank.

AMP Capital has assets under management of $192.4bn, with around two thirds of this coming from their internal channels such as AMP aligned financial advisers. This division is currently in fund outflow. The key question for investors is whether AMP can regain the trust of investors and stem fund outflows, or whether fund outflows are permanent?

AMP Bank has a lending book of around $20bn and the loan book saw a small decline for the first time since 2015. This division carries the same risks of the other retail banks in the event of potential for bad debts.

Nathan Bell, portfolio manager at Intelligent Investor says “within a few years after the recent AMP Life disposal and the sale of its New Zealand wealth management business slated for next year, AMP could have around $1.5bn of capital that could either be returned to share holders or reinvested to grow earnings. Incoming CEO De Ferrari (who starts on 1st Dec 2018) needs to increase the company's return on equity to 15% to earn all his bonuses, so theoretically investing the money would increase earnings by $225m, which in turn could see earnings per share move closer to 30 cents per share”.

Bell then suggests that if AMP was subsequently re-rated to 15 times earnings, assuming no deterioration or improvement from other divisions, the share price could be $4.50 (15 X 30 cents per share earnings). The dividend yield for investors with an entry price of $2.50 would also be attractive under this scenario according to Bell.

The problem with finding investments that can produce such a high return at the tail end of a bull market is that these opportunities often come with ‘warts’, and AMP’s business units are under immense pressure, which is why Bell is eager to hear De Ferrari's strategy. There are also suggestions De Ferrari will renegotiate his contract, as his bonus targets will be very difficult to achieve following the board's widely condemned deal announced recently to sell its AMP Life business.

It is always useful to understand how senior management is incentivised and the incoming CEO receives a large incentive if the share price reaches $5.25.

Matt Williams, Airlie Funds Management is watching AMP closely but has rarely invested in the company over his career. He cites a revolving door of management and a business with high fixed costs that is not really a leader in any of its market segments as reasons to be cautious. Airlie have recently met with AMP management but remain on the sideline at this stage.

Risks for AMP include De Ferrari not being able to restore the company’s reputation, continued fund outflows, financial market downturn which decreases fee revenue from funds under management, bad debts from the banking division not to mention the outcome from the Royal Commission with respect to vertical integration among other issues.

The best investment decisions are often the ones which make investors feel the most uncomfortable and on that count AMP rates highly, given the uncertainties. The strategy from the incoming CEO is the next piece of the puzzle for investors to help determine whether AMP is a turnaround in the making or a falling knife.