Mark Draper writes a monthly column for the Australian Financial Review - this article was published in September 2018

Apple has not only featured in the media for its latest range of iPhones and Watches, but also because it is Warren Buffett’s largest investment.

Warren Buffett owns around 5% of Apple shares (via Berkshire Hathaway) which recently became the first company to crack the US $1 trillion market capitalisation level. ($AUD 1,400,000,000,000) To put this in perspective, the market capitalisation of the entire ASX200 is only about 25% higher than that of Apple alone.

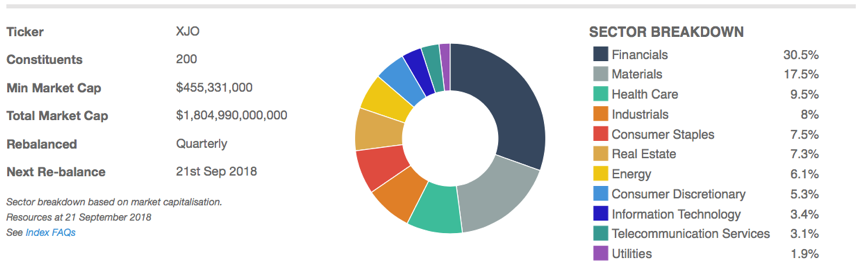

Even though technology is the one of fastest growing sectors globally, local investors are starved of IT opportunities in the ASX200 with technology comprising less than 4% of the index. Local investors with a focus on the domestic market may be missing out on Buffett’s wisdom.

Composition of the ASX 200

Buffett does not have a natural leaning toward technology manufacturers but at his recent annual meeting described Apple as a “very, very special product, which has an enormously widespread ecosystem, and the product is extremely sticky”. So what is behind the investment case for Apple?

The best place to start is to ask, how many of your friends and family own an iPhone?

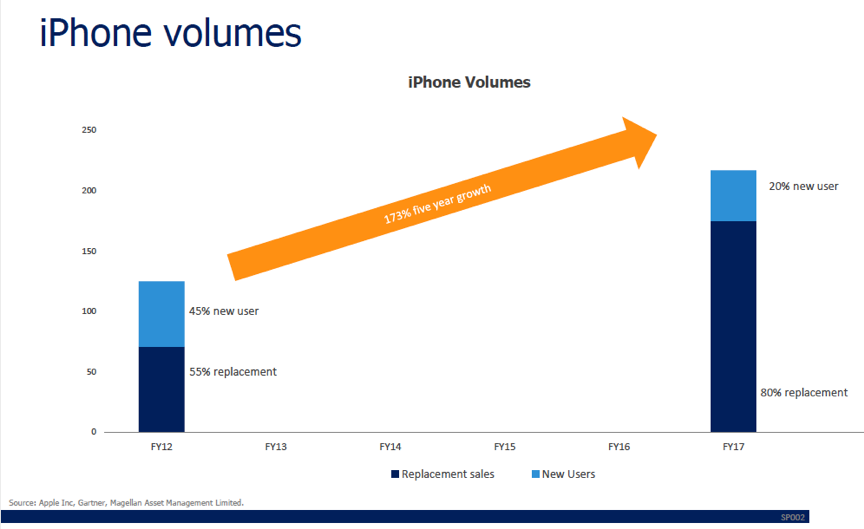

The iPhone is important to Apple as its sales represent around 60% of revenue, but what has changed in the last 5 years is the composition of iPhone sales. Magellan Asset Management estimate that in 2012 around 45% of iPhone sales were to new users. In 5 years this changed so that only 20% of iPhone sales are to new users, with 80% being sold as replacement handsets to existing users.

For investors, this means more consistent earnings in the form of recurring earnings, rather than one off handset sales. Magellan portfolio manager, Chris Wheldon describes the iPhone sales figures “as a subscription that Apple users are willing to pay every 2- 3 years, to remain in the Apple ecosystem”.

While revenue from iPhone sales YTD to 30th June 2018 is up an impressive 15%, what is more impressive according to Wheldon is the growth in the ‘Services’ business which is up 27% YTD. The Services business comprises of revenue from digital content and services including the App Store, Apple Music, iCloud, Apple Care and Apple Pay. Apple Music is now the most popular paid streaming service in the United States.

The Services business was the second largest division within Apple contributing over $27bn in revenue for the 9 months to 30th June 2018, which represents almost 15% of total revenue.

The Services business is largely recurring in nature and its strength relies on the number of Apple devices connected to the ‘ecosystem’. Earlier this year, Apple CEO Tim Cook stated in January 2018 that its active installed base of devices had reached 1.3bn, which includes iPhone, iPad, Mac and Apple Watches.

The ‘Wearables’ division which includes products like Airpods and Apple Watch is also growing strongly. In the last quarter of 2017, for the first time, Apple shipped more Apple watches than the entire Swiss Watch Industry, making Apple the largest watch maker in the world.

Wheldon believes the market may not yet fully appreciate the quantum and growth in the Services and Wearables businesses which could account for 35% of the total business in the future.

The technology bears would point to the high valuations of the dot.com boom at the turn of the century. To this end it is interesting to note that Apple currently trades on a forward looking 2019 price earnings ratio of around 16 (less if adjusted for cash holding), which for a business whose earnings are growing at a double digit rate does not seem excessive.

Investors can invest in Apple through many avenues, either by owning it directly or via listed invested companies/trusts from leading managers including Magellan, Platinum and Montgomery Investments. Some ETF’s also provide an entry point to technology companies.

Using technology is second nature in our everyday lives, so why wouldn’t investors make it second nature to their investment strategy as Warren Buffett has done?