The rate of Chinese debt growth, particularly in the corporate sector and local government sector is now at a level that is drawing attention from ratings agencies to infamous investors like George Soros.

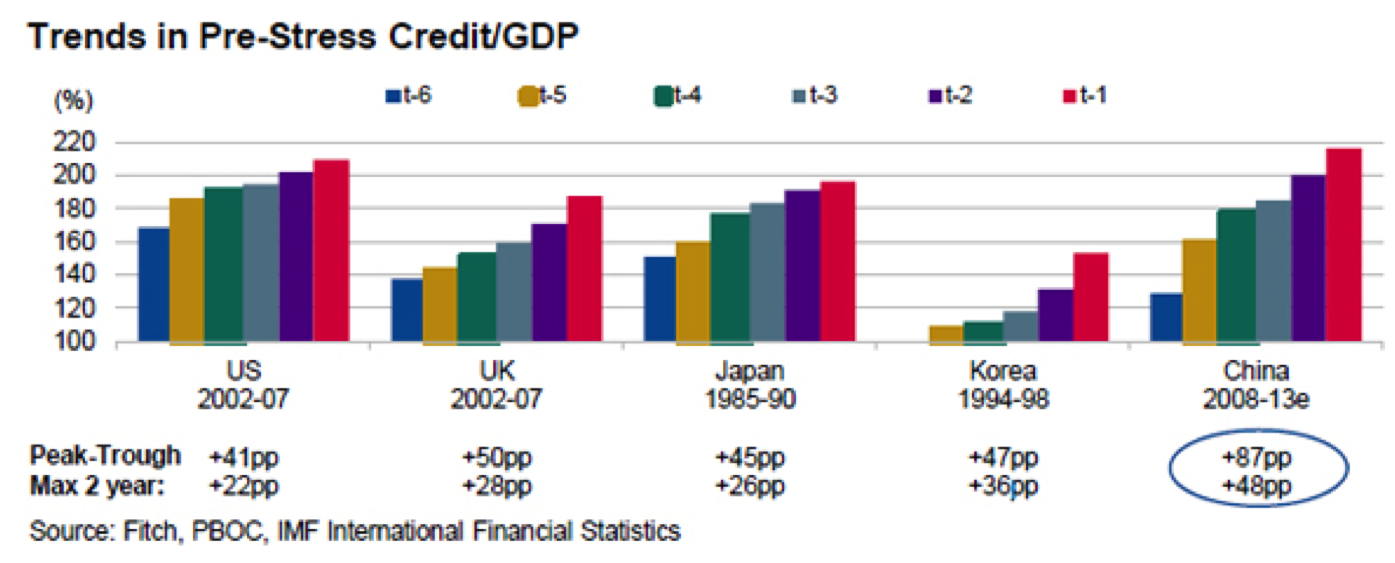

The chart below shows credit levels compared to GDP, and the rate of growth of credit (lending) in 5 countries at various points in time that represent 5 years that preceded a credit crisis. (Obviously Chinese credit crisis has not yet happened).

This chart shows similarities between China's level of debt and growth in debt in the past 5 years with the US and UK most recently and Japan and Korea in the 1990's. What followed in each of these scenarios was recession.

This growth in lending has largely funded Fixed Asset Investment, which is defined as capital expenditure of large items, such as roads, power stations, buildings.

If the rate of lending were to slow significantly, this would more than likely disrupt the level of fixed asset investment in China.

What does this have to do with Australia? Everything.

Australia currently exports vast quantities of commodities such as iron ore to China that is required for their Fixed Asset Investment program. A lower level of fixed asset investment would more than likely result in China importing lower quantities of some of Australia's major exports.

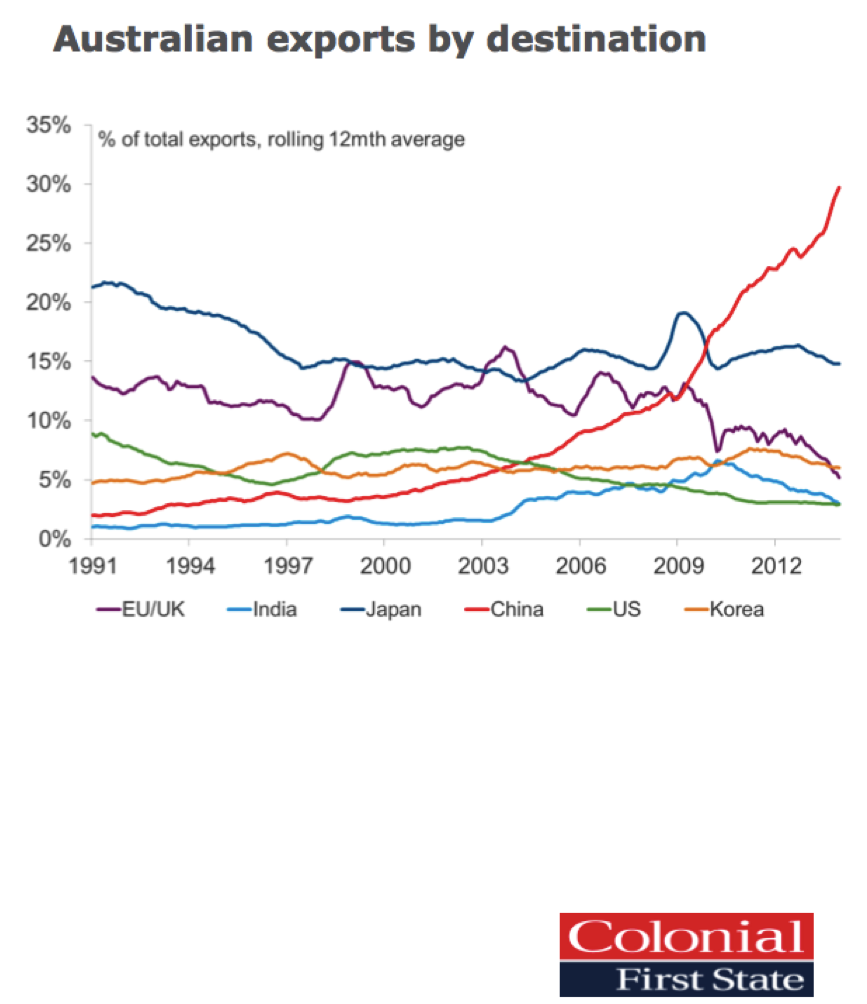

The chart below shows that China is now Australia's major export partner. It used to be said that if the US sneezed, Australia would catch a cold. Investors must now consider what happens to Australia if China sneezes.

Australia has enjoyed a decade of prosperity on the back of a China construction boom, which is now cooling. Many investments have profited from this. The challenge for investors now is to ensure that their investment strategy now is not anchored in the past.

DISCLAIMER: The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances.