The biggest event for global financial markets in 2017 is likely to have taken place on 20th January - when Donald Trump was sworn in as the 45th President of the United States.

The implications for the US economy and financial markets from President Trump is likely to involve three phases.

Phase one was 'risk off', with the unexpected election victory by Trump seeing the US equity market and the US dollar sell-off and US bond yields rally. This phase, however, lasted less than 24 hours, with the market quickly moving into the second phase.

The second phase, which ies expected to be the dominant factor throughout 2017, is supported by the view that Trump's policies will be expansionary and stimulatory - especially his company and income tax cuts, increased infrastructure spending and reduced regulatory environment.

This phase has already seen a strong rally in equity markets, the US dollar, a sell off in bond markets and is expected to be the primary factor driving markets throughout 2017. A noticeable increase in both business and consumer confidence has taken place since the election.

Further out, however phase 3 may not be as positive. Although the timing for phase three is very difficult to determine, it could be anywhere between 2018-2020, this phase is likely to involve an increase in inflation and a more aggressive monetary policy tightening cycle from the US Federal Reserve resulting in higher than expected interest rates.

In terms of the main policy agenda for President Trump, the following is expected (+, - and ? symbols indicate the direction of impact on the economy and markets)

+ Significant fiscal stimulus through a) large income tax cuts (3 rates 12%, 25% and 33%) b)company tax cuts (to 15% or 20% from 35%) and c) a 10% repatriation tax for cash currently held offshore by US corporates

+ Increase in infrastructure spending ie $300bn government spending, with private sector involvement potentially up to $1 trillion.

+ Increase in military spending - current and veterans

+ Reduce regulatory burden, especially on energy to achieve "complete American energy independance"

- Strongly protectionist stance - name China as a 'currency manipulator' and impose 45% tariffs on selected imported goods

- No support for TPP and change / withdraw from NAFTA - both important trade agreements

- Scale back climate change regulations

- Critical of US Federal Reserve policy, pro-audit, Chair Janet Yellen to be replaced in early 2018

- Isolationist stance of foreign policy - critical of NATO / some allies and China. Closer to Russia.

- Tough stance on immigration - building a wall

? Repeal and replace Obamacare.

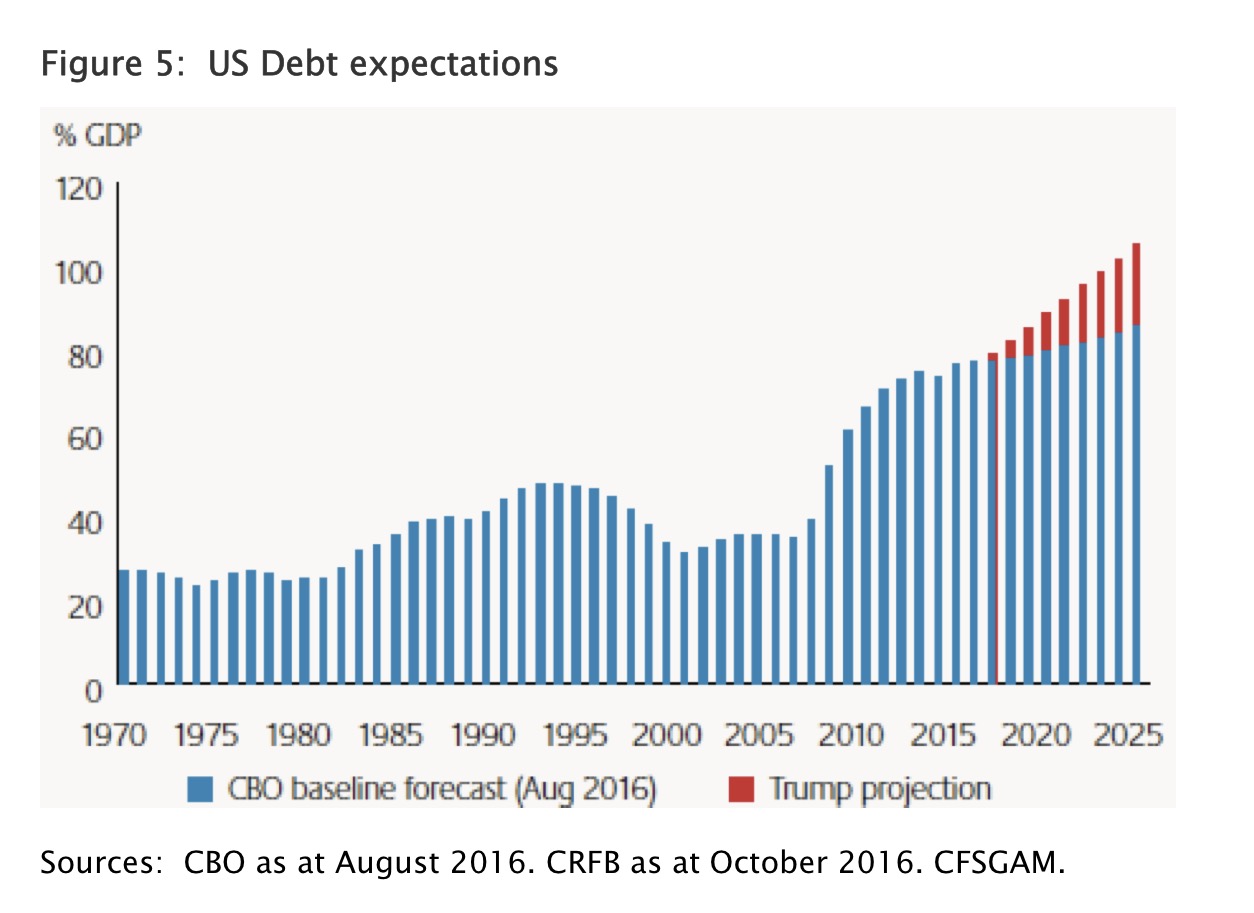

It has been estimated that Trump's policy agenda will increase the level of US Government debt by around 20% of GDP over the coming decade.

The key question for investors over 2017 and beyond is wil this be money well spent? Will President Trump's policies lead to a permanent shift higher in US's potentional economic growth rate?

This information is an extract from a presentation we attended by Stephen Halmarick (Chief Economist Colonial First State)

We will be producing a podcast that explores more about Trump's policy agenda in March with Dom Guiliano (Chief Investment Officer - Magellan Financial Group)