Mark Draper (GEM Capital) is writing a monthly column for the Australian Financial Review. This article will appear in the print edition of the Financial Review on Wednesday 13th June 2018.

Mark Draper (GEM Capital) is writing a monthly column for the Australian Financial Review. This article will appear in the print edition of the Financial Review on Wednesday 13th June 2018.

At the time of writing, Mark did not own Telstra shares.

If you have any story ideas that you would like us to write about, we would love to hear from you.

Here is the article.

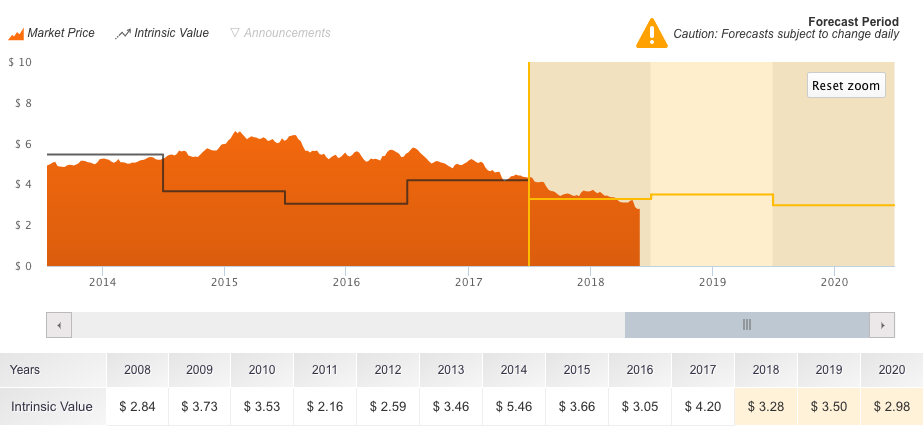

Telstra look’s cheap on a valuation model (see chart below), but is it a value trap?

The trouble with valuation models is that they rely on assumptions. We are of the view that it is better for investors to spend time thinking about what is likely to alter the inputs of valuation models, such as margins and competition rather than finessing the model itself.

Telstra has a dominant market position, the best infrastructure in the country and receives high margins for its services and yet trades on a Price Earnings ratio on a historic basis of less than 9 times.

The latest trading update from Telstra showed deteriorating earnings and falling margins. The bright spot for Telstra was that free cash flow was at the upper end of forecasts, while earnings was at the low end. The dividend at 22 cents per share for this year was confirmed, putting the stock on a juicy yield of over 7% fully franked. The dividend on a medium term view however is under a cloud, particularly once the one off NBN payments stop. It is important for investors to look beyond todays yield and to concentrate on the future earnings of Telstra in order to determine value.

Telstra earns most of its money from broadband and mobile divisions, so it is critical that investors understand what is happening in these divisions well.

The core earnings of the Mobile division are under pressure. After years of customers flooding to Telstra’s mobile network, a recapitalised Vodafone is growing market share and TPG will turn on their network later in 2018, initially offering free service for 6 months and then offering plans at a jaw dropping rate of $9.99 per month. Average revenue per user in Telstra’s mobile division is around $65 per month today, but TPG and other competitors are likely to force this to below $50 per month according to analysts at Intelligent Investor. Telstra currently enjoys margins from its mobile business of around 40% but this margin as well as customer numbers are under threat.

The NBN offers no comfort for Telstra share holders either, as around 180 NBN resellers are fighting for market share. The economic model of the NBN looks challenged, but even if access charges to NBN resellers were to fall, there is no certainty that the price cut to access charges would improve margins, or simply be competed away. As the NBN grows it transforms Telstra from an asset owner into a reseller.

5G, which is to be launched next year, potentially makes parts of the NBN redundant according to several institutional investors. That is a potential positive for Telstra as they would receive income directly from their 5G customers, most likely at a higher margin than reselling the NBN. The unknowable question however is how much will Telstra need to spend to buy 5G spectrum.

Roger Montgomery from Montgomery Investment Management currently believes the ability for Telstra management to cut costs is under-appreciated by the market. Telstra has already announced cost savings of $1.5bn, but if larger savings can be made, this could help fill an earnings blackhole of around $3bn.

Telstra is an outstanding mobile operator with infrastructure advantages, but the risky thing is its ambition to offset declining broadband and mobile margins with a plan to become a global technology business. If management can execute this strategy well, shareholders would be rewarded, but it carries material execution risk.

Telstra management plan to provide a critical update to the market during June 2018 about their future plans for business.

It seems that there is universal agreement that Telstra’s earnings decline in the foreseeable future. So despite the share price having some valuation appeal we are likely to wait until the June update from management before making our next move.

Souce: Skaffold