Why investors should take notice of rising bond rates

Are the Bond market ghosts of 1994 coming back to haunt, or is this as high as long term interest rates rise? That’s unknowable at this stage, but investors should ensure their portfolio’s can weather rising interest rates.

Investment strategies that worked well while interest rates fell, are unlikely to be rewarded when rates rise.

Long term interest rates, particularly the 10 Year US bond rate (also known as the risk free rate of return) is important to investors as an anchor point against which asset prices such as property and shares, are measured. Generally speaking a higher long term interest rate results in lower asset prices, in the absence of earnings growth.

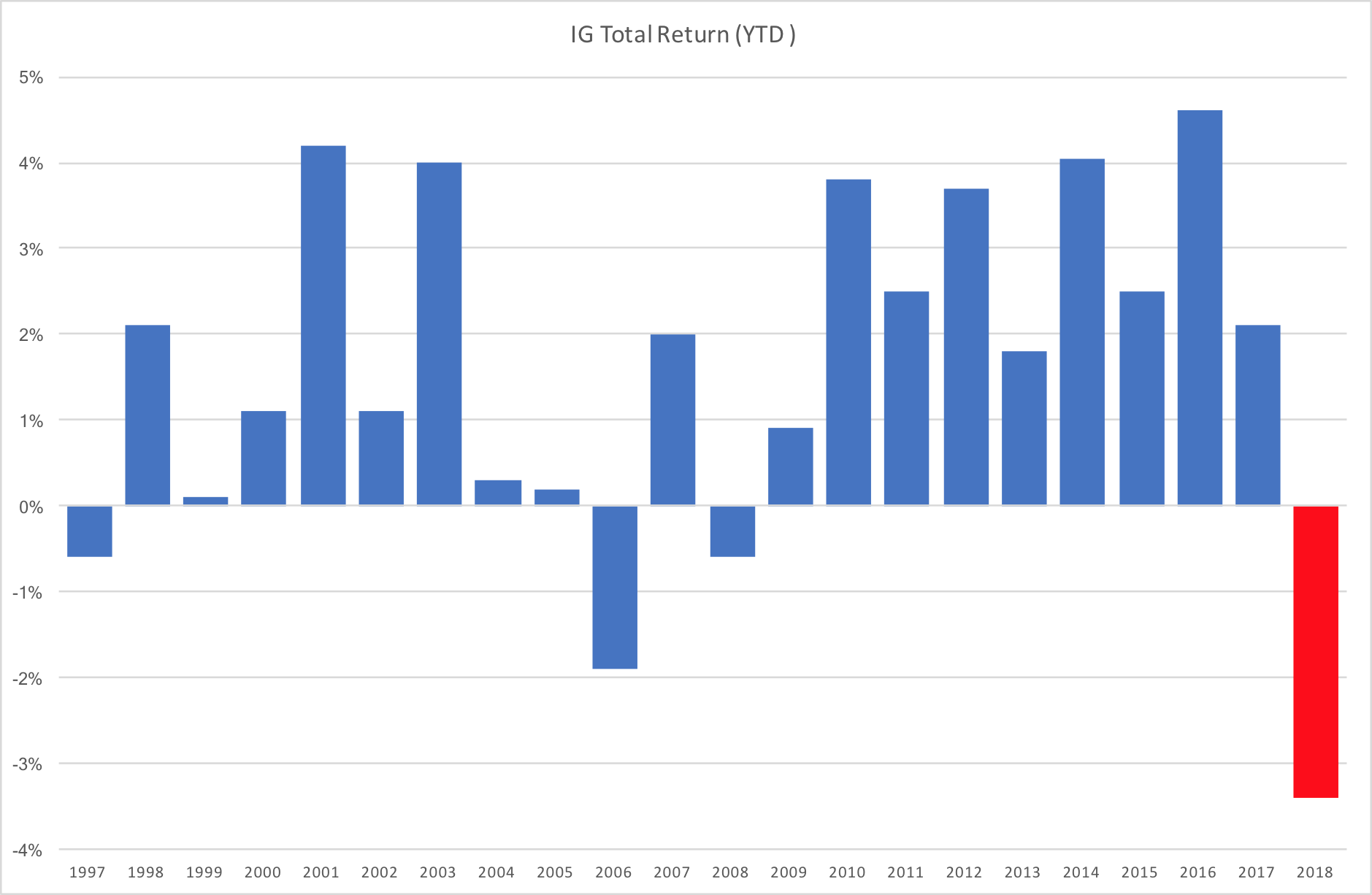

Future inflation expectations are filtering into long term interest rates following stronger than expected US wage growth in the first few months of 2018. This has resulted in the total returns for Investment Grade (IG) bonds having their worst start to a year in 20 years.

Chart provided courtesy of Intelligent Investor

US 10 Year Rates have doubled since July 2016 from under 1.5% to currently around 3%. This has seen long term bond prices fall (price of bonds fall as rates rise). Assets considered bond proxies including infrastructure and property have also come under pressure during this time.

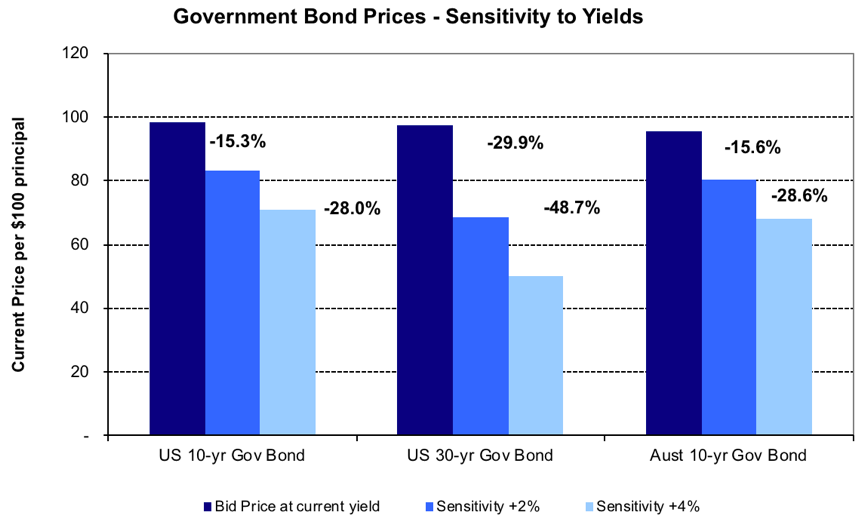

Long term bonds, which feature in many investors portfolio’s under the labels of “Fixed Interest”, “Bond” or “Conservative” funds/ETF’s are vulnerable to rising interest rates, particularly those with longer duration. While rising interest rates increase the income from bonds, rising rates can be devasting to the capital value of a bond portfolio owned in managed funds, ETF’s and super funds. The chart below shows the capital destruction of US Bonds and Australian 10 Year bonds in the event of rates rising by 2% and 4% respectively from current levels. Not exactly a defensive investment in a rising interest rate environment!

Source: Bloomberg

Bond proxies such as infrastructure and property are generally considered to be negatively impacted by rising long term rates, but caution is required before dismissing these assets during periods of rising rates.

Assets such as toll roads can offer some protection from rising inflation and increasing interest rates as toll revenue is usually linked to inflation. Therefore rising inflation (which generally feeds higher interest rates) can result in material earnings growth for toll roads. Citylink tolls as an example are linked to inflation.

Infrastructure businesses can see an increase in the cost of debt funding as rates rise, and these businesses generally carry high levels of debt. While higher interest rates obviously increase the cost of debt servicing, good infrastructure businesses have used the extended period of low interest rates to secure long term debt at low rates which means that the impact of rising interest rates may not be seen for many years. During 2017, Zurich Airport, raised debt for a 12 year term at 0.6214% interest.

Property investors where rents are linked to CPI can offer some protection against rising inflation and rising rates, but there are some property sectors where rents are under pressure, such as retail property.

While clearly there are potential losers from rising interest rates, there are also potential winners. Companies that hold large fixed interest portfolios of short duration, such as insurance companies stand to earn materially higher levels of investment income. Computershare is another listed company in Australia whose earnings stand to benefit from rising rates from client funds it holds.

For other parts of the share market, rising company profits are the best defence against the negative valuation effects of rising rates. Earnings growth for the ASX200 is forecast to remain at high single digits for financial years 2018 and 2019 (source Ausbil Roadshow) and Asian company earnings are forecast to grow at double digits this year. This should cushion share prices against the valuation impact of rising rates.

With the unwinding of Quantitative Easing (money printing) in the US, and with the Euro region likely to follow suit soon, it seems that the interest rate environment has changed. Investors should check their investment strategy is positioned for a rising interest rate environment.