Warren Buffett (one of the world's best investors) previously stated that he believes the recovery in the US Housing market will be a defining moment for the US economy.

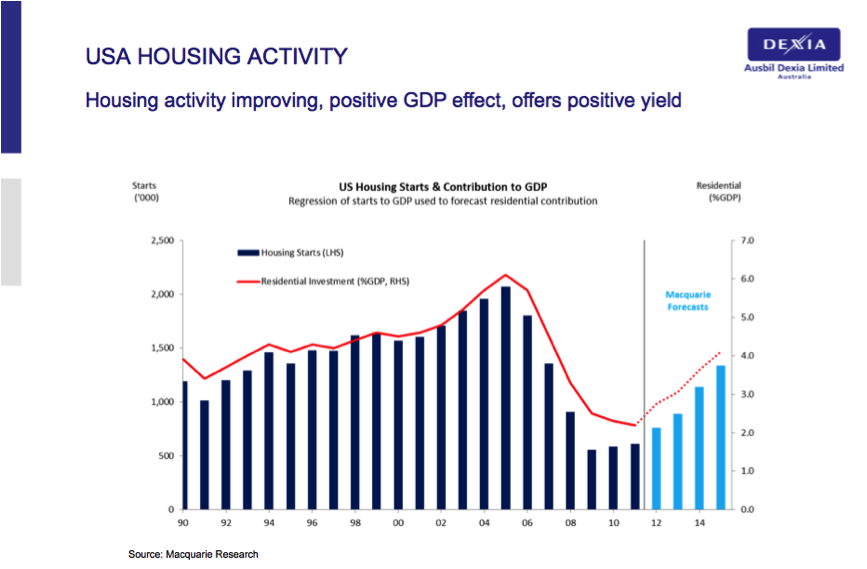

It is considered that the annual underlying demand for houses in the US is 1.5 million houses per year due to immigration and family formation. For example, since the Global Financial Crisis the US population has increased by over 10 million. The chart below shows the number of new houses being currently built as around 600,000 per year which is well below annual demand. At the moment this does not represent a problem as there is as oversupply of housing due to the housing boom leading up to 2007. During that time many more houses were built than the underlying demand, which lead to surplus housing stock (and let's face it you can only live in one house at a time).

The key message here is that in time the surplus housing stock will be soaked up by demand that is not being met with new home building currently. This explains Macquaries research which shows (in blue bars) the likely trend for US Home Building over coming years as ultimately the US will have to build houses to keep up with demand.

The question for Australian investors is how can you take advantage of this?

This material has been provided for general information purposes and must not be construed as investment advice. This material has been prepared without taking into account the investment objectives, financial situation or particular needs of any particular person. Investors should consider obtaining professional investment advice tailored to their specific circumstances prior to making any investment decisions and should read the relevant Product Disclosure Statement.